In the dynamic landscape of entrepreneurship, understanding business funding for startups is essential for aspiring entrepreneurs seeking to turn their innovative ideas into reality. As we navigate through 2023, startups are exploring a myriad of funding options, from venture capital and crowdfunding platforms to government grants for entrepreneurs. These diverse financial resources are crucial for not only launching a business but also sustaining its growth in a competitive market. Sustainable startup funding has gained traction, emphasizing the importance of ethical and environmentally conscious practices in securing investment. This blog will unpack the available funding resources for new ventures and the strategies entrepreneurs can employ to attract the necessary capital.

Navigating the financial landscape for emerging enterprises necessitates a comprehensive understanding of startup funding solutions. Securing capital has become an intricate process, with various avenues such as angel investments, public crowdfunding campaigns, and state-sponsored grants tailored for new businesses. Entrepreneurs today can leverage these diverse funding mechanisms to enhance their chances of success, including the growing field of socially responsible investing. With a focus on eco-friendly practices, sustainable funding sources have become increasingly relevant, aligning financial opportunities with current trends towards environmental stewardship. This exploration will shed light on alternative financial pathways available to startups and their implications for long-term viability.

Exploring Business Funding for Startups: Essential Avenues

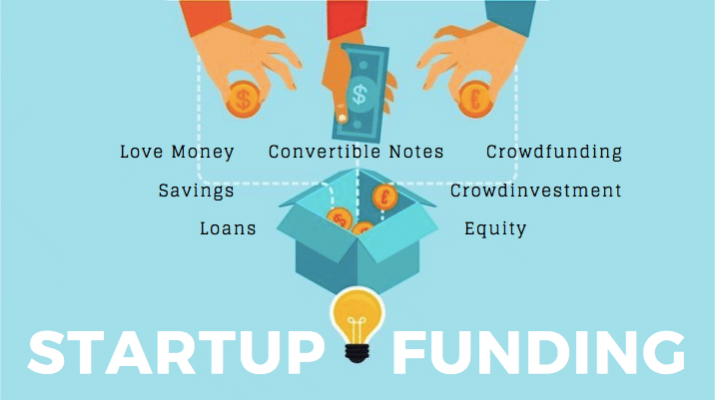

Business funding for startups encompasses a wide range of options tailored to the unique challenges entrepreneurs face today. To navigate this complex landscape, it’s crucial for founders to understand the various funding mechanisms available. From traditional venture capital to innovative crowdfunding platforms, each funding source has its advantages and specific criteria. Startups should conduct thorough research to align their funding strategy with their business goals, identifying which type of funding is the best fit for their operational model and growth trajectory.

Moreover, entrepreneurs must also be aware of the nuances within these funding sources. For instance, while venture capital can provide substantial capital for scaling, it often comes with the expectation of rapid growth and a clear exit strategy. Conversely, crowdfunding allows startups the flexibility to engage directly with their customer base, ensuring that their product has market validation before launch. By exploring these essential avenues, startups can secure the necessary funding to sustain operations and drive growth.

Venture Capital for Startups: A Renewed Interest Amidst Market Changes

Venture capital for startups has witnessed a resurgence in interest, particularly as the market stabilizes post-pandemic. As reported by PitchBook, investors are increasingly keen to inject funds into burgeoning sectors such as artificial intelligence, biotechnology, and green technologies. This revitalization is not only critical for scaling innovative startups but also signals a shift in investor focus towards sustainable and technologically driven companies, which often promise better returns. Understanding this shift can enable entrepreneurs to tailor their pitches to attract the right kind of investment.

Moreover, successful startups must align their projects with current market trends to catch the attention of venture capitalists. Startups that can showcase a strong business model that meets the demands of a tech-savvy consumer base are more likely to attract substantial venture capital funding. The relationship between startups and venture capitalists often goes beyond mere funding; it includes mentorship, industry connections, and strategic guidance essential for navigating the complexities of scaling a business.

Crowdfunding for Startups: Democratizing Financial Support

Crowdfunding for startups has emerged as a powerful tool for aspiring entrepreneurs to raise capital directly from potential customers and supporters. Platforms like Kickstarter and Indiegogo allow startups to showcase their innovative ideas to a broad audience, enabling them not only to gather funds but also to test market interest prior to launching a product. This model represents a shift from traditional funding, creating a community around a venture where backers become invested stakeholders in the startup’s success.

Additionally, equity crowdfunding platforms, such as SeedInvest and Republic, enable everyday individuals to invest in startups, providing entrepreneurs with access to a wider pool of small investors. This democratization of investment offers startups a means to build a loyal customer base while cultivating community support. However, for successful crowdfunding campaigns, startups must meticulously strategize their marketing efforts and maintain clear communication with their backers throughout the funding process.

Government Grants for Entrepreneurs: Unlocking Financial Resources

Government grants for entrepreneurs play a pivotal role in providing necessary financial support to startups, particularly those focused on innovation and technology. Programs offered by entities like the Small Business Administration (SBA) are designed to reduce the financial barriers that often hinder startup growth. These grants can cover critical areas such as research and development, allowing entrepreneurs to allocate funds towards product improvement without the immediate pressures of revenue generation.

In various regions, governments have also tailored their grant programs to stimulate economic growth and job creation, incentivizing startups that align with socio-economic development goals. Entrepreneurs seeking funding can significantly enhance their financial strategies by identifying and applying for relevant government grants, thereby leveraging public resources to support their ventures.

Sustainable Startup Funding: A Growing Commitment to ESG

Sustainable startup funding has rapidly ascended the agenda for many investors, reflecting a broader commitment to Environmental, Social, and Governance (ESG) principles. As awareness regarding climate change and social responsibility increases, investors are more likely to support startups that prioritize sustainability in their operations and business models. Startups that integrate eco-friendly processes not only enhance their appeal to a conscious consumer base but can also tap into a more specialized funding sphere led by investors driven by a sustainable mission.

The emphasis on sustainability also fosters innovation, encouraging startups to devise solutions that address critical global challenges. Financing options that prioritize sustainability, such as green venture capital and dedicated impact funds, are becoming increasingly inclusive, providing both financial backing and guidance to entrepreneurs committed to making positive change. By aligning their objectives with sustainable practices, startups can improve their chances of securing funding while contributing significantly to a more sustainable future.

Funding Resources for New Ventures: Essential Tools and Guidance

Effective funding resources for new ventures empower entrepreneurs to navigate the complex financial landscape with confidence. Platforms like Crunchbase and AngelList offer entrepreneurs access to valuable data regarding funding trends, investor profiles, and other crucial insights that can guide their approach to securing capital. By utilizing these resources, startups can make informed decisions, tailoring their pitches to align with what investors are currently seeking in a rapidly changing market.

In addition to online resources, many incubators and accelerators, such as Y Combinator and Techstars, provide structured programs that combine mentorship, networking opportunities, and financial infusion. These programs not only prepare new ventures for scaling but also connect them with experienced industry professionals who can offer valuable insights and guidance. By leveraging these tools and resources, startups can enhance their chances of success and navigate the challenges of raising capital effectively.

Frequently Asked Questions

What are the best options for business funding for startups in 2023?

In 2023, startups can explore several options for business funding, including venture capital for startups, crowdfunding platforms like Kickstarter and Indiegogo, and government grants for entrepreneurs. Each option caters to different needs, with venture capital offering substantial investment opportunities, while crowdfunding allows direct public engagement. Additionally, government support through grants can alleviate financial pressures, making it easier for startups to develop and launch their products without immediate revenue concerns.

| Key Point | Details |

|---|---|

| Venture Capital Revival | Venture capital funding is recovering after a downturn, focusing on technology sectors like AI and healthcare. |

| Alternative Funding Sources | Crowdfunding platforms allow public participation in funding, increasing campaign visibility and community support. |

| Government Support Programs | Various government grants, particularly from the SBA, help startups mitigate financial pressures and encourage innovation. |

| Focus on Sustainability | Businesses prioritizing ESG criteria can attract conscious investors, leading to better long-term resilience. |

| Resources and Tools | Platforms like Crunchbase and AngelList provide essential insights for startups looking to secure funding. |

Summary

Business funding for startups is an essential aspect of entrepreneurial success in today’s rapidly changing financial landscape. Understanding the current dynamics—such as the resurgence of venture capital, the rise of crowdfunding, government incentives, and the emphasis on sustainability—equip entrepreneurs with the tools needed to thrive. Startups must leverage diverse funding strategies and innovative resources to navigate this complex environment effectively. By clearly aligning their business objectives with these opportunities, they can secure the necessary capital to turn their visions into reality.

Venture capital has become a popular funding option for startups seeking rapid growth and substantial financial backing. Venture capitalists (VCs) typically invest in early-stage companies with high growth potential in exchange for equity stakes. This type of funding is often accompanied by mentorship and strategic guidance, as VCs not only provide capital but also leverage their industry experience and networks to help startups scale effectively. Many tech companies have benefitted from venture capital support to innovate and secure their place in competitive markets.

Crowdfunding has emerged as a revolutionary method for startups to raise funds from a vast pool of individual investors, often through online platforms like Kickstarter or Indiegogo. This approach allows entrepreneurs to launch their projects by pre-selling products, gaining early market feedback, and building a community of supporters. Crowdfunding not only provides financial resources but also serves as a marketing tool, helping startups validate their business ideas and create brand awareness before fully launching their products.

Government grants can be a vital resource for entrepreneurs looking to fund their startups without the obligation of repaying funds, as is the case with loans or equity financing. Many governments offer grants and funding competitions aimed at fostering innovation and supporting small businesses, particularly in sectors such as technology, research, and sustainable development. These grants can provide essential financial support, allowing entrepreneurs to focus on developing their products and services rather than worrying about financial burdens.

Sustainable startup funding is increasingly becoming a focal point for entrepreneurs who aim to create businesses that positively impact the environment and society. This funding approach emphasizes social entrepreneurship and the importance of environmentally-friendly practices. Startups focused on sustainability may seek funds from investors who prioritize environmental impact or explore niche sources of funding like impact investing, which seeks a financial return alongside measurable social or environmental benefits. Innovative solutions that align profits with purpose are gaining traction in the startup ecosystem.

Funding resources for new ventures encompass a variety of options, allowing entrepreneurs to choose the best fit for their specific needs and goals. Beyond venture capital, crowdfunding, and government grants, options such as angel investors, small business loans, and accelerators can offer critical support to startups at different stages of development. Understanding the unique advantages and challenges of each funding source is essential for entrepreneurs, as it enables them to strategically plan their funding approach and maximize their chances of long-term success.