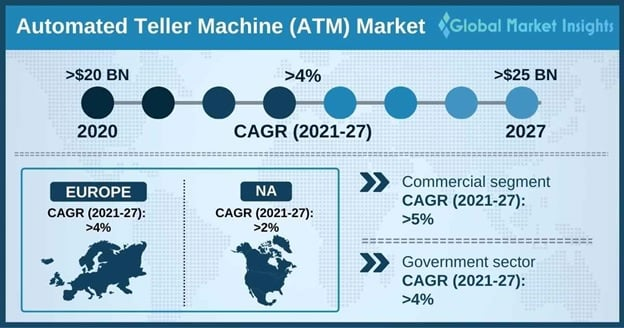

The ATM machine market is currently experiencing significant advancements and growth, driven by increasing consumer demand for convenient banking solutions. As more individuals rely on Automated Teller Machines for quick access to cash and essential banking services, this sector is projected to expand to USD 34.68 billion by 2030. Innovations such as biometric authentication and contactless transactions are enhancing user experiences and ramping up security, making ATMs essential in today’s digital economy. Furthermore, financial inclusion remains a key factor as ATMs serve populations in remote and underserved areas, bridging the gap in banking access. Despite challenges like the rise of digital banking and operational costs, the ATM machine market presents numerous opportunities for growth and innovation, paving the way for a robust future in the financial landscape.

The landscape of Automated Teller Machines, often simply referred to as ATMs, is experiencing a transformative phase that impacts both consumers and financial institutions. This segment of the self-service banking sector is not only adapting to shifting customer preferences but also harnessing technological advancements to streamline operations. With projections indicating a thriving ATM market that could reach new heights by the end of the decade, businesses are rallying to enhance service offerings while addressing concerns such as security and maintenance. As these cash dispensing machines evolve, they continue to play a pivotal role in facilitating financial transactions across diverse demographics, emphasizing the importance of accessibility in banking solutions. The convergence of innovation and operational strategy in the ATM marketplace presents exciting possibilities for both established brands and emerging players.

Applying for a merchant account is a crucial step for businesses looking to accept credit and debit card payments. The first step in the application process involves selecting a payment processor or bank that offers merchant accounts. It’s essential to research various providers, comparing their rates, fees, customer service, and terms of service. Once you’ve chosen a provider, visit their website to complete the initial application form. This form typically requires information about your business, such as its legal structure, average transaction amounts, and the estimated monthly volume of card transactions. Be prepared to provide documentation such as your business license, tax ID, and financial records, as these are often required for processing your application.

After submitting your application, the payment processor or bank will review your information to determine your eligibility for a merchant account. This process may involve a credit check and additional verification steps, which can take anywhere from a few hours to several days. Once your application is approved, you will receive a contract detailing the terms of your merchant account, including fees associated with processing transactions, monthly fees, and equipment rental if needed. Be sure to read through this contract carefully before signing to avoid any surprises later. If you have questions or need assistance, most providers offer customer support that can help guide you through the setup process and ensure that you are fully equipped to begin accepting payments. For more detailed guidance, you may want to visit websites such as PayPal, Square, or Stripe, which also provide excellent resources for new merchants.

The Role of ATMs in Financial Inclusion

Automated Teller Machines (ATMs) play a crucial role in promoting financial inclusion, particularly in developing regions where traditional banking infrastructure is limited. By providing accessible financial services, ATMs enable individuals to perform essential transactions such as withdrawals, deposits, and even bill payments without the need to visit a bank branch. This capability is especially important in rural areas, where banks may be sparse. The presence of ATMs not only empowers unbanked populations but also fuels economic growth by making banking services available to a broader audience.

Moreover, the ATM machine market’s expansion in emerging economies is paving the way for improved financial literacy and engagement among local communities. As more people gain access to ATMs, they become familiar with banking processes, leading to increased savings and investment. Additionally, financial institutions can leverage data from ATM transactions to tailor their services and outreach efforts, further enhancing the potential for financial inclusion. Thus, ATMs serve as a bridge that connects underserved communities to the financial ecosystem.

Technological Advancements Transforming the ATM Landscape

The ATM machine market is experiencing a technological metamorphosis, driven by innovations that enhance user experience and operational efficiency. Modern ATMs are now equipped with biometric authentication systems, such as fingerprint and facial recognition technologies, which significantly improve security. These advancements not only protect users’ financial information but also build trust in ATM services. Furthermore, the integration of Artificial Intelligence (AI) allows ATMs to provide personalized experiences, assisting customers in real-time and making banking more intuitive than ever.

In addition to security features, contactless transactions at ATMs have gained traction, primarily due to health concerns and a growing preference for convenience. Users can now withdraw cash without physically touching the machine, which caters to a health-conscious population. Coupled with Robotic Process Automation (RPA) to streamline operations, these technological advancements contribute to a more efficient ATM network. Consequently, the ATM landscape is evolving to meet changing consumer demands while ensuring safety and reliability.

Challenges Facing the ATM Machine Market

While the ATM machine market is on the rise, it encounters several challenges that could hinder its progress. The growing preference for digital banking and mobile payment solutions signifies a shift in consumer behavior away from cash transactions. As younger generations increasingly favor cashless payments, traditional ATMs may see a decline in usage. This transition could pose a threat to the relevance and profitability of ATMs, forcing operators to rethink their service models and adapt to the digital landscape.

Furthermore, maintaining ATMs can be cost-prohibitive, especially for operators in competitive markets. Expenses related to maintenance, cash replenishment, and the necessary security measures can accumulate quickly. As these costs rise, they may discourage potential new entrants into the market, ultimately stifling innovation and reducing the number of accessible ATMs. Addressing these financial challenges is crucial for sustaining growth and ensuring that ATMs continue to thrive as essential components of the financial system.

Lastly, as ATMs become more technologically advanced, they also face increasing cybersecurity threats. The rise of sophisticated hacking methods means that operators need to invest significantly in cybersecurity measures. Failure to adequately protect ATM systems from breaches not only heightens financial risk but can also damage consumer trust in the safety of using ATMs.

Unlocking Opportunities in the ATM Market

Despite the challenges facing the ATM machine market, numerous opportunities for expansion and innovation exist. One significant opportunity lies in deploying ATMs in rural and underserved regions, where access to banking services remains limited. By installing ATMs in these areas, financial institutions can effectively bridge the gap in service provision, allowing communities to engage with the banking system and fostering economic growth. This strategic move not only increases operational footprints for businesses but also significantly enhances financial accessibility for residents of these areas.

Additionally, there is potential for the implementation of innovative service models at ATMs by offering value-added services such as bill payments, mobile recharges, and money transfers. Such services can attract more users and create additional revenue streams for ATM operators. By adapting to consumer needs and offering a wider array of financial services, businesses can ensure that ATMs remain relevant and indispensable in an evolving financial landscape. This adaptability is key to unlocking future growth in the ATM machine market.

| Key Point | Details |

|---|---|

| Market Growth | Projected to reach USD 34.68 billion by 2030 with a CAGR of 6.5% from 2022. |

| Financial Inclusion | Emerging economies are adopting ATMs, increasing access to banking services. |

| Self-Service Solutions | Consumers prefer ATMs for convenience and control without tellers. |

| Urbanization | As cities expand, ATM installation increases to meet banking service demands. |

| Technological Advancements | Biometric tech, AI, and contactless transactions improve security and user experience. |

| Regulatory Challenges | Stricter data protection regulations require enhanced security measures by operators. |

| Maintenance and Costs | High operational costs may deter new market entrants. |

| Cybersecurity Threats | Increased risks require robust cybersecurity investments. |

| Opportunities for Expansion | Deploying ATMs in rural areas can enhance financial inclusion and accessibility. |

| Innovative Service Models | Value-added services at ATMs could attract more users and increase revenue. |

Summary

The ATM machine market is experiencing a significant transformation, highlighted by impressive growth projections and the dynamic adaptation of technology. As we explore the rapid expansion towards a predicted worth of USD 34.68 billion by 2030, it is clear that the ATM machine market continues to thrive amidst rising digital banking trends. Enhanced financial inclusion, urbanization, and consumer desire for self-service banking options underscore the market’s potential. Technological innovations enhance security and streamline operations, while regulatory landscapes evolve to prioritize consumer protection. Nevertheless, challenges such as maintenance costs and cybersecurity risks persist. Despite these hurdles, the potential for expansion into underserved regions and the exploration of innovative service models offers promising opportunities for businesses. Therefore, as the ATM machine market evolves, stakeholders must remain agile to capitalize on these developments.

The ATM machine market is experiencing significant evolution and growth in a world increasingly dominated by technological innovations and cashless transactions. With projections indicating that the market could reach USD 34.68 billion by 2030, the landscape for Automated Teller Machines is more dynamic than ever. These vital pieces of financial infrastructure play a crucial role in facilitating access to banking services, especially in areas with limited traditional banking options. As we explore the trends shaping the ATM market growth, including advancements like biometric authentication and AI integration, it becomes clear that both challenges and opportunities lie ahead for operators and service providers. Understanding these elements will be essential for stakeholders looking to capitalize on the ongoing transformation in the world of ATMs.

In the realm of financial technology, the sector encompassing automated teller machines (ATMs) is witnessing remarkable changes that mirror consumer preferences and technological advancements. This market, often referred to as the automated banking services landscape, is not only adapting but thriving amidst the rise of digital banking and evolving customer expectations. The continued integration of self-service solutions into this landscape highlights a growing demand for convenience and enhanced security features, such as contactless transactions. Furthermore, as financial institutions strive for broader financial inclusion, the expansion efforts into underserved communities reveal significant growth potential. Delving into the dynamics of this automated banking segment will unveil both the emerging opportunities and the challenges faced by market participants.

Frequently Asked Questions

What are the current trends in the ATM machine market?

The ATM machine market is currently experiencing significant growth, estimated to expand at a CAGR of 6.5%, reaching USD 34.68 billion by 2030. Key trends driving this growth include increased financial inclusion in emerging economies, a rising demand for self-service banking solutions, and urbanization leading to more ATM installations in city areas.

How are technological advancements impacting the ATM market growth?

Technological advancements are revolutionizing the ATM machine market by enhancing security and user experience. Innovations like biometric authentication, AI, contactless transactions, and robotic process automation are making ATMs more reliable and efficient, thus attracting more users and contributing positively to the overall market growth.

What challenges does the ATM machine market face amid its growth?

Despite its growth, the ATM machine market faces significant challenges, including the growing preference for digital banking over cash transactions, high maintenance costs for ATM operations, and increased cybersecurity threats that require robust protective measures to safeguard against potential breaches.

What opportunities exist for businesses in the ATM machine market?

Businesses have numerous opportunities in the ATM machine market, particularly in expanding into underserved regions where financial services are limited. Additionally, incorporating innovative service models, such as value-added services at ATMs, can attract more users and generate new revenue streams, enhancing financial inclusion.

Automated Teller Machines (ATMs) have become a cornerstone of modern banking, providing customers with easy access to their funds, 24/7, without the need for human intervention. Originally introduced in the late 1960s, ATMs have evolved significantly, enhancing convenience and efficiency in financial transactions. Their ability to dispense cash, transfer funds, and even facilitate bill payments has led to a dramatic shift in consumer banking preferences, with countless users now opting for self-service solutions over traditional banking methods.

The ATM market has experienced robust growth over the past decade, driven by a rising demand for convenient banking solutions and an increasing number of bank branches offering ATM services. Countries with developing economies are particularly witnessing significant ATM deployment as financial institutions leverage this technology to reach underserved populations. The global ATM market is also expanding due to the proliferation of cashless payment systems and a growing emphasis on digital banking solutions, which have fortified the relevance of ATMs as cash withdrawal points in both urban and rural areas.

Technological advancements in ATMs have greatly enhanced their functionality and security. Features like biometric identification, contactless transactions, and advanced encryption protocols have been adopted to improve user experience while ensuring the safety of transactions. Moreover, the integration of artificial intelligence and machine learning is paving the way for smarter, more interactive ATMs capable of providing personalized financial advice and support. These advancements not only simplify the user experience but also bolster the operational efficiency of financial institutions.

Financial inclusion is a crucial benefit facilitated by ATMs, particularly in remote or underserved regions where traditional banking services may not be readily available. By providing cash access without the need for a bank branch, ATMs empower individuals to participate in the financial system, encouraging savings and enabling access to loans and other banking services. This democratization of banking services is essential for driving economic growth and reducing poverty, highlighting the significant role ATMs play in contemporary society.

Despite their many advantages, ATMs face several challenges and opportunities in the ever-evolving financial landscape. Increased competition from digital payment platforms and banking apps puts pressure on traditional ATM services. Additionally, concerns over security breaches and the maintenance costs associated with outdated machines necessitate a reevaluation of ATM deployment strategies. However, these challenges also present opportunities for innovation, prompting banks to invest in cutting-edge technology and expand their ATM networks to offer enhanced services, thereby ensuring that ATMs remain relevant in the accelerating digital age.

The Automated Teller Machine (ATM) market has evolved into a dynamic field, experiencing ongoing advancements and trends that reflect changing consumer behaviors and technological landscapes. As digital currencies rise, the market is projected to expand significantly, driven by increasing consumer demand for convenience and the urgency of financial inclusivity in developing regions. Factors such as urbanization and the ongoing shift towards self-service banking options further substantiate the growing relevance of ATMs in the contemporary financial ecosystem. With an anticipated compound annual growth rate of 6.5% leading up to 2030, the market’s potential becomes even more apparent as it adapts to the diverse needs of users globally.

Technological innovations are reshaping the ATM landscape, making it essential for businesses to stay abreast of the latest advancements. The incorporation of biometric authentication methods enhances transaction security, while artificial intelligence offers personalized user experiences that refine customer interactions at ATMs. Contactless transaction capabilities have become particularly significant, especially in response to health concerns regarding surface contact, thereby driving an increase in ATM usage. Additionally, Robotic Process Automation (RPA) is streamlining operations, ensuring optimal performance and management of ATMs, which bolsters the profitability and reliability of this financial technology.

While the ATM market presents promising growth opportunities, businesses must navigate a complex regulatory environment to ensure compliance and security. As governments impose stricter data protection regulations, operators are faced with the responsibility of safeguarding consumer information through robust security measures. Additionally, anti-fraud initiatives are vital to maintaining trust in ATM services. The regulatory landscape necessitates that companies not only adapt to evolving requirements but also invest in technology and strategies that enhance consumer protection against potential cyber threats.

Despite these challenges, the trajectory of the ATM sector is bright, particularly in underserved areas where financial services are scarce. Expanding ATM accessibility in rural regions presents a significant opportunity to facilitate financial inclusion, allowing communities to engage with banking services that were previously out of reach. Furthermore, businesses can leverage innovative service propositions at ATMs, integrating additional functions such as bill payments and remittance services, thereby diversifying revenue streams and enhancing customer engagement.

In conclusion, the ATM machine market stands at a pivotal juncture characterized by both challenges and opportunities. As technology continues to evolve and consumer expectations shift towards convenience and security, companies in this sector must remain agile and responsive to market demands. By focusing on innovation, implementing stringent security measures, and prioritizing operational excellence, businesses can position themselves advantageously within this expanding market. Engaging with comprehensive industry resources will further illuminate the nuances of the ATM landscape, guiding stakeholders toward informed strategic decisions.