Business funding strategies are pivotal for entrepreneurs in South Africa looking to transform their innovative ideas into successful ventures. As traditional funding methods evolve, a plethora of options such as venture capital, crowdfunding, and government grants have emerged to meet the diverse needs of startups. These funding sources not only provide the necessary capital but also help entrepreneurs navigate the competitive landscape. With a focus on impact investing and various support programs, South African businesses can find financial backing tailored to their unique circumstances. This article delves into the current trends and strategies available for securing funding, propelling your business towards sustainable growth and success.

In the realm of entrepreneurial financing, various terms and concepts can significantly enhance business prospects. Alternatives like startup capital, angel investments, and community-based funding options are gaining traction among South African entrepreneurs. These funding avenues cater to specific industries and entrepreneurial needs while also demonstrating social impact. Businesses can explore these alternative solutions, such as venture philanthropy and public funding initiatives, to maximize their financial resources. Understanding these diverse funding environments is crucial for entrepreneurs to build robust and resilient business models.

Exploring Business Funding Strategies

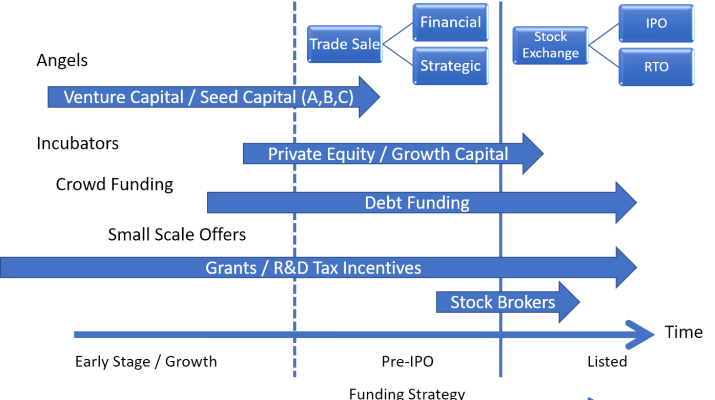

In the ever-evolving landscape of entrepreneurship in South Africa, it’s crucial for business owners to explore various funding strategies to ensure the growth and success of their ventures. One key term that has gained traction is ‘business funding strategies,’ which encompasses a range of options from traditional loans to innovative methods like crowdfunding. Entrepreneurs must identify which strategy aligns best with their business needs, as the right funding can provide the necessary capital for launching or scaling a business.

One of the most notable aspects of business funding strategies in South Africa is the rise of venture capital and private equity investments. With venture capitalists increasingly interested in tech-driven sectors such as fintech and agritech, startups can harness these funds to propel their businesses forward. By understanding the nuances of attracting venture capital and aligning with investor goals, entrepreneurs can open doors to significant funding opportunities.

Crowdfunding: A New Frontier for South African Entrepreneurs

Crowdfunding in South Africa has transformed the funding landscape for entrepreneurs looking to raise capital. With platforms like Thundafund and GoGetFunding, entrepreneurs can reach out to their communities for support, highlighting a key aspect of crowdfunding: the ability to engage potential customers before the product or service is even launched. This direct engagement not only fosters community support but also provides invaluable feedback that can guide the business’s development.

Successful crowdfunding campaigns hinge on the power of storytelling and demonstrating clear value to backers. As supported by the South African Crowdfunding Association, showcasing your business’s mission effectively can attract passionate supporters who resonate with your goals. In an era where social media plays a pivotal role in marketing, leveraging these platforms to enhance visibility and reach for crowdfunding initiatives can significantly increase the likelihood of campaign success.

Leveraging Government Grants and Programs

Government funding plays a critical role in supporting small businesses in South Africa. Various programs, particularly those initiated by the Department of Small Business Development, aim to provide financial assistance and resources to entrepreneurs. These grants are particularly beneficial for startups impacted by challenges such as the COVID-19 pandemic, offering a lifeline to many who might otherwise struggle to secure funding.

Entrepreneurs should be proactive in seeking out these government initiatives, as numerous programs exist to assist with everything from business development to mentorship. By applying early and thoroughly researching available grants like SEDA, businesses can enhance their chances of receiving essential financial support while also benefiting from guidance and mentoring that can help shape successful business strategies.

Understanding Impact Investing in South Africa

Impact investing has emerged as an attractive funding strategy for socially responsible startups in South Africa. This form of investment seeks to create a positive social impact while also generating a financial return, appealing to a new wave of investors who are committed to addressing essential social issues like unemployment and inequality. In the current landscape, entrepreneurs who align their business models with the principles of impact investing can unlock new funding avenues.

To capture the interest of impact investors, entrepreneurs must be able to articulate their social mission clearly and demonstrate measurable outcomes from their business endeavors. Transparency and a well-defined social impact narrative can resonate strongly with potential investors who want their funds to contribute positively to societal challenges while also yielding returns.

Accelerator Programs as a Catalyst for Business Growth

Participating in accelerator programs can drastically enhance the growth trajectory of South African startups. Programs like Startupbootcamp Africa provide access to mentorship, invaluable resources, and networking opportunities that are essential for entrepreneurs navigating the early stages of building a business. By connecting startups with industry experts, these programs foster an environment conducive to innovation and creativity.

Moreover, accelerator programs often culminate in demo days where startups can present their ideas to potential investors, creating direct access to critical funding sources. For entrepreneurs within these programs, not only do they gain the chance to refine their business models, but they also develop relationships with peers and mentors that can lead to future collaborations and partnerships, further enhancing their business viability.

Frequently Asked Questions

What are the most effective business funding strategies for entrepreneurs in South Africa?

In South Africa, entrepreneurs have access to several effective business funding strategies including venture capital, crowdfunding, government grants, and impact investing. Venture capital is particularly popular among startups in tech sectors, while crowdfunding platforms like Thundafund enable entrepreneurs to raise funds directly from their communities. The South African government also provides grants through programs such as the Department of Small Business Development. For socially responsible ventures, impact investing has become a growing trend, focusing on businesses that provide social benefits alongside financial returns. Entrepreneurs should consider these diverse funding options to align with their specific business goals.

| Business Funding Strategy | Key Advantages | Considerations | Examples |

|---|---|---|---|

| Venture Capital and Private Equity | Significant funding increase, focuses on tech-driven sectors. | Requires a strong business plan and alignment with investor goals. | PwC’s 2023 Survey, investments in fintech, agritech, healthtech. |

| Crowdfunding Platforms | Direct community engagement and validation of business ideas. | Success depends on storytelling and effective marketing. | Thundafund, GoGetFunding. |

| Government Programs and Grants | Financial support and guidance for startups. | Limited availability and competition for grants. | SEDA, DSBD financial initiatives. |

| Impact Investing | Focus on socially responsible business models and returns. | Investors look for tangible social outcomes in pitches. | GIIN trends on social investments. |

| Networking and Accelerator Programs | Access to mentorship, support, and potential funding. | May require a significant commitment of time and resources. | Startupbootcamp Africa, The Business Place. |

Summary

Business funding strategies have become increasingly vital for South African entrepreneurs navigating the complexities of starting and growing their ventures. From venture capital that targets tech innovations to crowdfunding platforms engaging local communities, each strategy offers unique benefits and challenges. Government programs provide crucial backing, while impact investing appeals to those with a social mission. Accelerator programs enhance networking and access to expertise, creating a supportive ecosystem for business growth. Selecting the right funding strategy can define the success of a new venture, making it essential for entrepreneurs to align these strategies with their specific business goals and industry dynamics.

Entrepreneur funding in South Africa has seen significant growth, driven by a burgeoning startup ecosystem. The country offers various funding avenues for entrepreneurs, including private investors, angel networks, and a range of financial institutions. One key aspect is the willingness of local investors to back innovative ideas, particularly those that address social challenges and contribute to economic growth. Additionally, many accelerators and incubators in South Africa provide resources and mentorship, further aiding in the success of new businesses.

Venture capital in South Africa has become increasingly prevalent as the startup culture matures. Several VC firms are actively seeking investment opportunities in high-growth sectors such as technology, fintech, and health care. These firms provide not only financial support but also strategic guidance, networks, and resources essential for scaling businesses. However, entrepreneurs often face challenges in accessing venture capital due to the competitive landscape and the rigorous criteria set by investors, making it crucial for startups to be well-prepared and aligned with market demands.

Crowdfunding in South Africa has emerged as a viable funding option for entrepreneurs looking to raise capital without sacrificing equity. Platforms such as Thundafund and Uprise.Africa allow businesses to tap into community support and encourage public participation in funding innovative projects. This model not only raises funds but also validates business ideas. However, successful crowdfunding campaigns require effective marketing strategies and a compelling narrative, as potential backers seek projects that resonate with their interests and values.

Government grants in South Africa are aimed at promoting entrepreneurship and aiding small businesses in navigating initial growth challenges. Various state-funded programs, such as the Department of Trade and Industry (DTI) initiatives, offer funding for startups that meet specific criteria, focusing on job creation, technology innovation, and export readiness. While these grants significantly alleviate financial pressure, the application process can be complex and competitive, necessitating entrepreneurs to thoroughly prepare their proposals and demonstrate their potential impact on the economy.

Impact investing in South Africa reflects a growing interest among investors who seek to generate social and environmental impact alongside financial returns. This investment strategy is particularly vital in a country marked by socio-economic challenges. Impact funds often target sectors such as renewable energy, education, and healthcare, where potential returns can align with positive societal outcomes. By bridging the gap between profit and purpose, impact investing encourages businesses to innovate while simultaneously addressing critical issues in South Africa’s diverse communities.