When it comes to navigating the financial landscape of starting a business, understanding effective business funding strategies is crucial for entrepreneurs. In South Africa, innovative funding avenues are opening up, providing diverse options like government grants, venture capital, and crowdfunding platforms that empower startups. Aspiring business owners can benefit significantly from these funding solutions, enabling them to bring their visions to life without excessive financial burdens. Additionally, engaging with angel investors in South Africa has become an appealing route for many, as these investors often offer not just capital but also valuable mentorship. This guide explores essential strategies to help South African entrepreneurs secure the funding they need to thrive.

The pursuit of capital is a foundational aspect for budding business owners, and discovering innovative financing methods can be a game-changer. Financial backing for startups comes in various shapes and forms, from angel investment networks to alternative lending solutions, each tailored to meet the unique challenges of South African entrepreneurs. Moreover, the landscape is enriched with opportunities such as crowdfunding, which allows individuals to tap into community support and resources. By effectively leveraging these diverse funding alternatives, entrepreneurs can not only access much-needed resources but also validate their business concepts and expand their networks. In this guide, we will delve deeper into the various channels available to secure essential capital for ambitious ventures.

Applying for a merchant account typically begins with researching various payment processors that meet your business needs. It’s essential to compare the fees, transaction rates, and integration options that each provider offers. Once you’ve chosen a payment processor, visit their website and look for the merchant account application section. This usually involves filling out an online form where you’ll need to provide essential information about your business, including your business structure, average transaction volume, and industry type. Additionally, be prepared to submit documentation such as your business license, tax ID, and bank account details to facilitate the review process.

After submitting your application, the payment processor will review your information and may require further documentation or a verification call. This process can take anywhere from a few hours to a few days, depending on the provider. If approved, you’ll receive details on how to set up your account, integrate payment processing solutions into your website or store, and begin accepting payments from customers. Always ensure you read the service agreement and understand the terms, especially around fees and chargeback policies, before finalizing your account. If you’re not sure where to start, consider websites like Merchant Maverick or PaySimple that provide detailed reviews and comparisons of different merchant services.

Understanding Business Funding Strategies in South Africa

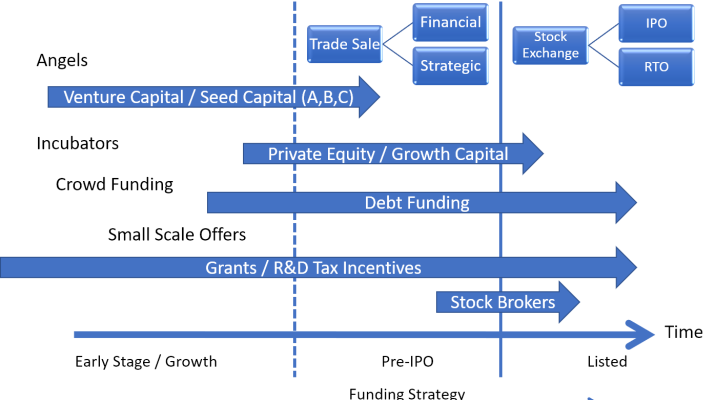

Business funding strategies play a crucial role in the success of startups and emerging businesses in South Africa. Entrepreneurs face unique challenges when seeking funds, which makes understanding the local funding ecosystem essential. Essential funding strategies particularly focus on networks and partnerships that provide both financial resources and guidance. Moreover, entrepreneurs must tailor their approaches according to their business needs, industry demands, and available opportunities, making it clear that there’s no one-size-fits-all solution.

A deep dive into the South African market reveals a variety of options that entrepreneurs can tap into, from government grants to angel investors and crowdfunding platforms. By leveraging business funding strategies, startups can navigate barriers to traditional funding sources, which often require stringent conditions and extensive paperwork. Understanding local funding avenues not only empowers entrepreneurs but also contributes to the broader economy by fostering innovation and competition.

Leveraging Government Grants for Business Growth

Government grants serve as a significant opportunity for entrepreneurs in South Africa, aimed at promoting small and medium enterprises (SMEs). Programs offered by institutions like the Department of Small Business Development make funds accessible without the pressure of repayment. This risk-free avenue attracts many startup founders who wish to invest in their dreams without incurring debt. Thus, understanding the application processes of government grants is vital to ensuring that these resources are optimally utilized.

In 2023, numerous initiatives continue to provide support for entrepreneurs aiming to access government grants. The emphasis remains on empowering South African entrepreneurs with the tools to succeed, fostering an environment that encourages innovation and business development. Moreover, these grants often direct funds towards specific industries or sustainability projects, which can also appeal to investors. Therefore, entrepreneurs must stay informed about available grants and continuously explore how to align their businesses with funding criteria.

Connecting with Angel Investors in South Africa

Angel investors have become increasingly interested in supporting innovative ventures in South Africa. These affluent individuals play a critical role in the entrepreneurial journey as they provide not just financial support but also mentorship and strategic guidance. The South African entrepreneurship ecosystem benefits greatly from the involvement of angel investors who are willing to take risks on early-stage companies. Moreover, entrepreneurs are encouraged to effectively pitch their ideas and demonstrate potential market value to attract these investors.

Networking events organized by groups such as the South African Venture Capital Association (SAVCA) serve as platforms for budding entrepreneurs to connect with potential angel investors. Building relationships with these investors can lead to invaluable opportunities for funding and growth. Entrepreneurs must cultivate a strong value proposition and demonstrate the potential for scalable growth to capture the attention of angel investors actively seeking new ventures within the South African market.

The Rise of Crowdfunding Platforms in South Africa

Crowdfunding platforms have emerged as a transformative tool for South African entrepreneurs looking to raise capital. With traditional funding avenues often posing barriers, crowdfunding allows founders to pitch their business concepts directly to the public through platforms like Thundafund and Uprise.Africa. This method encourages community engagement and democratizes funding, enabling entrepreneurs to engage with potential supporters and simultaneously validate their ideas in the process.

One significant advantage of using crowdfunding is access to a broader audience than traditional investment channels typically allow. Whether it’s seeking funds for a startup or a specific project, entrepreneurs can reach out to a diverse demographic interested in their vision. Beyond merely raising funds, crowdfunding initiatives enable entrepreneurs to build a loyal customer base and generate market interest ahead of their product launch, making it a strategic choice for funding. As the trend continues to grow, understanding the mechanics of these platforms becomes pivotal for any entrepreneur.

Alternative Financing Options for Startups

For many entrepreneurs in South Africa, traditional financing can be daunting due to high-interest rates and stringent qualifying criteria. This scenario has led to a rise in alternative financing options, such as peer-to-peer lending and online financial solutions. Platforms like Lulalend have developed unique offerings that cater to the funding needs of small businesses, providing easier access to working capital when traditional banks are not an option.

Alternative financing provides flexibility in terms of repayment schedules and often requires less documentation than conventional methods. These accessible options are critical for South African startups that may experience cash flow challenges in their initial stages. Now more than ever, entrepreneurs are recognizing the value of these alternative funding sources as they provide the necessary capital without the drawbacks of traditional financing, enabling them to focus on innovation and growth.

Building Networks and Mentorship for Funding Success

Networking and mentorship have continuously proven to be potent tools in securing business funding for South African entrepreneurs. Establishing connections with fellow entrepreneurs, potential investors, and seasoned mentors offers valuable insights and opens doors to unique funding opportunities. Participating in events facilitated by organizations like Business Partners Limited can help emerging business leaders engage with communities that understand their struggles and have resources to share.

Furthermore, having a mentor significantly impacts an entrepreneur’s journey by providing guidance, support, and the confidence needed to navigate the competitive funding landscape. Entrepreneurs equipped with networks and mentors can tap into various funding strategies that range from personal connections to formal fundraising initiatives, making it imperative to foster these relationships throughout their business development process.

Navigating the Digital Transformation in Funding Strategies

The digital transformation has brought an unprecedented shift in how South African entrepreneurs approach funding. With technology driving innovation, many startups are leveraging digital platforms to access funding and streamline operations. This trend has resulted in new avenues for financial support, including online crowdfunding, fintech lending solutions, and investor connections facilitated through digital networks.

Entrepreneurs embracing digital transformation within their business models are often more attractive to investors, as they reflect adaptability and a forward-looking approach. Moreover, the ability to showcase business ideas digitally allows entrepreneurs to reach a larger audience, enhancing their chances of securing funding. As this trend continues, staying updated on digital funding solutions is crucial for aspiring business owners seeking investment in South Africa’s ever-evolving market.

Funding Trends Impacting South African Entrepreneurs

As South Africa’s entrepreneurial landscape evolves, funding trends play a pivotal role in shaping strategies. Increasing emphasis on sustainability and socially responsible practices resonates with today’s investors who are searching for businesses that prioritize long-term impact over short-term profits. Entrepreneurs who align their business models with sustainable practices not only open doors to various funding sources but also enhance their appeal to socially-conscious investors.

Additionally, the rise of angel investors and venture capital firms highlights a growing interest in funding innovative technology startups. As the demand for tech solutions increases, entrepreneurs creating impactful and scalable tech ventures may benefit from this influx of capital aimed at advancing the digital economy. Understanding these trends is essential for South African entrepreneurs to implement effective funding strategies that cater to the current market dynamics.

Creating a Sustainable Business Funding Ecosystem

Building a sustainable funding ecosystem requires collaboration between different stakeholders in the entrepreneurial landscape. Government, private investors, and financial institutions must work together to create an environment conducive to growth and innovation. Initiatives that promote resource sharing, networking, and mentorship can greatly enhance the chances of success for startups seeking funding.

Furthermore, transparency and accessibility in funding processes will benefit all parties involved, ensuring that entrepreneurs can focus on building sustainable businesses rather than navigating complex funding requirements. By fostering collaboration and a shared vision among funders and entrepreneurs, South Africa can develop a vibrant ecosystem that supports the growth of innovative ventures and transformational ideas.

| Funding Strategy | Description | Key Initiatives/Platforms |

|---|---|---|

| Access to Government Grants and Support | Government programs providing grants and support specifically for small and medium enterprises. | Small Enterprise Development Agency (SEDA), Business Growth Fund, Promotion of Access to Information Act (PAIA) |

| Venture Capital and Angel Investors | Investors and venture capital firms provide funding for early-stage companies, along with mentorship opportunities. | 4Di Capital, Huddleson, Angel Investment Network |

| Crowdfunding Platforms | Online platforms enable entrepreneurs to raise funds directly from the public, validating their ideas in the process. | Thundafund, Uprise.Africa |

| Alternative Financing Options | Non-traditional funding sources like peer-to-peer lending offer more accessible financing compared to banks. | Lulalend, RainFin, Thundafund |

| Networking and Mentorship Programs | Connecting with mentors and fellow entrepreneurs opens doors to funding and valuable business insights. | Business Partners Limited |

Summary

Business funding strategies are essential for entrepreneurs in South Africa, offering innovative approaches to secure necessary financial backing. By leveraging government grants, engaging venture capitalists, utilizing crowdfunding platforms, exploring alternative financing options, and networking effectively, entrepreneurs can navigate the landscape of business funding more adeptly. Understanding these strategies not only aids in acquiring funds but also fosters growth and sustainability in an increasingly competitive market. As South Africa’s entrepreneurial ecosystem matures, these strategies will continue to evolve, providing dynamic solutions to meet the financial needs of businesses.

Business funding strategies are crucial for South African entrepreneurs striving to turn their innovative ideas into successful ventures. In the competitive landscape of business, understanding how to secure funding is essential, whether it involves accessing government grants South Africa has made available or attracting interest from angel investors South Africa boasts. This guide will delve into various funding for startups avenues, equipping aspiring business owners with effective techniques that meet their unique needs. As we uncover these strategies, we will explore the potential of crowdfunding platforms and other innovative financial models to provide the necessary support for growth and sustainability. By mastering these strategies, entrepreneurs can position themselves to thrive in South Africa’s dynamic economic environment.

Exploring effective methods for business financing is vital for any entrepreneur, particularly in a diverse market like South Africa. With the emergence of various funding options—from traditional avenues like government support programs to modern approaches such as crowdfunding and venture capital—business owners have more opportunities than ever to secure their necessary resources. Understanding these capital acquisition strategies can empower startups and small businesses to realize their full potential. Moreover, alternative investment sources, such as angel investors and peer-to-peer lending platforms, provide unique pathways to funding that can catalyze growth and innovation. By leveraging these financial resources, South African businesses can not only survive but thrive in an increasingly competitive landscape.

Frequently Asked Questions

What are some effective business funding strategies for South Africa’s entrepreneurs?

South African entrepreneurs can utilize multiple business funding strategies to secure financial support. Important avenues include accessing government grants specifically designed for SMEs, such as those offered by the Department of Small Business Development, which can provide crucial funding without repayment. Additionally, securing investment from angel investors in South Africa, who are increasingly interested in early-stage startups, can offer both financial backing and mentorship. Entrepreneurs should also consider crowdfunding platforms like Thundafund and Uprise.Africa to reach a broader audience and validate their ideas. Lastly, alternative financing options like peer-to-peer lending can provide additional resources with more flexible terms, helping entrepreneurs to sustain their businesses.

In South Africa, funding for startups has become a pivotal aspect of the entrepreneurial landscape. Access to capital is often a significant barrier for new businesses, and various funding sources have emerged to address this issue. Entrepreneurs looking to launch innovative ideas are increasingly turning to government grants, which can provide much-needed financial support for early-stage ventures. These grants are typically aimed at promoting economic growth, job creation, and fostering innovation within the country.

South African entrepreneurs are showing resilience and creativity in a landscape marked by challenges. The support for these entrepreneurs is evident through initiatives aimed at empowering them with the necessary resources. Networks of angel investors have been established, providing vital funding and mentoring to nascent businesses. These investors play a crucial role by not only offering capital but also sharing their expertise and industry connections, which can be instrumental for startup success.

Government grants in South Africa represent a significant opportunity for startups to secure funding without the burden of repayment. Various government initiatives, such as the Department of Trade, Industry and Competition’s grants, aim to assist startups in different sectors, including technology and manufacturing. Startups can apply for funding to help them grow, expand their market reach, or invest in research and development, thus aligning their business objectives with national economic goals.

Angel investors in South Africa are becoming increasingly active in the startup ecosystem, providing both financial backing and strategic guidance. Many of these investors are successful entrepreneurs themselves, allowing them to offer valuable insights based on their own experiences. Their investment can often mean the difference between a startup floundering and thriving, as they not only inject capital but also champion the business through their networks and influence.

Crowdfunding platforms have gained traction as an alternative source of funding for South African startups. With the rise of digital technology, entrepreneurs can now reach potential investors through online campaigns, pooling small amounts of money from a large number of people. Platforms like Thundafund and Uprise.Africa allow startups to showcase their ideas to the public, creating opportunities for people to invest in ventures they believe in. This democratization of funding has enabled many entrepreneurs to bypass traditional financing routes, fueling innovation and growth.

In South Africa’s dynamic entrepreneurial landscape, securing funding is often a crucial hurdle for startups. While traditional bank loans might be less accessible due to stringent requirements, government grants provide an essential lifeline. The Department of Small Business Development offers various grants, financing programs, and resources tailored to support small and medium enterprises (SMEs). Entrepreneurs can leverage these grants, which typically do not require repayment, thereby alleviating financial pressures as they establish and grow their businesses.

Another significant strategy for South African entrepreneurs is tapping into venture capital and angel investors. These investors are increasingly drawn to innovative startups with high growth potential. By attending networking events organized by organizations like the South African Venture Capital Association, entrepreneurs can connect with individuals and firms interested in investing in fresh ideas. This not only provides necessary funding but also opens avenues for mentorship and strategic guidance, crucial for navigating the early stages of business development.

Crowdfunding has exploded in popularity as an alternative funding route, allowing entrepreneurs to directly engage with potential supporters through platforms like Thundafund and Uprise.Africa. These avenues empower businesses to share their projects widely and tap into the collective financial support of communities. The interactive nature of crowdfunding not only provides financial backing but also acts as a marketing tool, validating business ideas in the eyes of both investors and customers, all while fostering a loyal supporter base.

In recent years, alternative financing options have reshaped the funding landscape for South African entrepreneurs. Peer-to-peer lending platforms such as RainFin and Lulalend offer more flexible terms and accessible capital compared to traditional banks. This shift allows entrepreneurs to secure quick funding with less bureaucratic overhead, enabling them to focus on growing their businesses rather than navigating complex loan applications and waiting for approvals.

Furthermore, the importance of networking and mentorship cannot be understated. Engaging with communities of entrepreneurs and mentors fosters invaluable connections that can lead to financial opportunities. Organizations like Business Partners Limited provide platforms for entrepreneurs to share experiences, gain practical insights, and access potential funding. These interactions help demystify the funding process and empower entrepreneurs to make informed decisions when seeking financial support.