Payments innovation is revolutionizing the way we conduct financial transactions, offering speed, efficiency, and accessibility that traditional banking often lacks.With the rise of digital payments, fintech regulations are taking center stage as lawmakers contemplate the best ways to modernize the financial landscape.

Existing Business

If you have an existing business and need info

AI Payments Assistant Revolutionizing Banking at Bank of America

The emergence of the AI Payments Assistant marks a significant step forward in how Bank of America leverages technology to enhance customer interactions.By integrating generative AI in finance, this innovative assistant, known as AskGPS, is designed to simplify payments technology and improve operational efficiency for businesses.

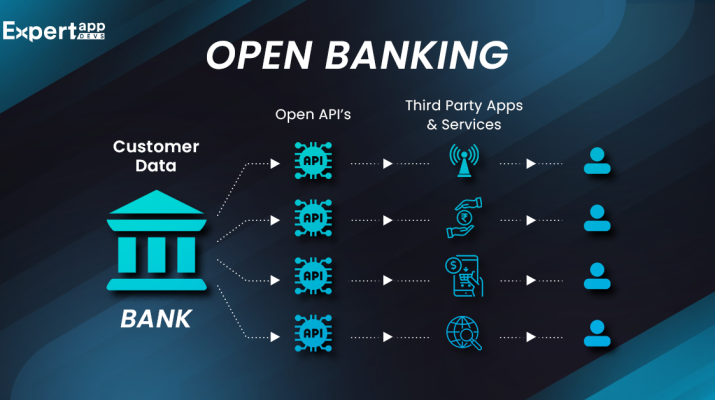

Open Banking: How Fintech Companies Enhance Financial Systems

Open banking is revolutionizing the financial landscape by facilitating seamless access to consumer financial data among banks and fintech companies.This innovative system empowers consumers to have greater control over their financial information, enabling them to make informed decisions and switch between financial institutions with ease.

Federal Reserve Debit Card Fees: Regulations Under Appeal

Federal Reserve debit card fees are currently a hot topic in the financial landscape, particularly following a recent court decision that challenged the regulations governing these charges.The Federal Reserve is appealing a ruling that could significantly impact how debit card transaction fees are determined, raising questions about the future of interchange fee standards.

Roughrider Stablecoin: North Dakota’s Digital Currency Launch

The launch of the Roughrider stablecoin marks a significant milestone in the evolution of digital currencies, positioning North Dakota at the forefront of this financial innovation.Developed in collaboration with the Bank of North Dakota, this state-issued stablecoin aims to streamline banking transactions and enhance the overall efficiency of the state’s financial ecosystem.

MoneyLion Lawsuit: Baltimore Takes Action Against Lending Tactics

The MoneyLion lawsuit has recently emerged as a pivotal case in the ongoing battle against predatory lending practices in Baltimore.Local officials allege that the fintech operates akin to a “modern-day payday lender,” using exploitative tactics that ensnare vulnerable consumers into a cycle of debt through its high-cost lending schemes.

DailyPay CEO Appointment: Nelson Chai Takes the Lead

This week, DailyPay made headlines with the appointment of Nelson Chai as its new chief executive officer, marking a significant milestone in the company’s evolution.Chai, who has previously held prestigious roles such as the chief financial officer at Uber Technologies, steps into this leadership role after serving as a director at the earned wage access firm for 10 months.

BNPL Credit Reporting: A Step Towards Financial Inclusion

BNPL credit reporting is revolutionizing the landscape of consumer finance by providing clarity and transparency in borrowing.With the rising popularity of buy now, pay later services among over 90 million Americans, it’s crucial that BNPL providers begin sharing their customers’ repayment data with credit bureaus.

Checkout.com Banking Charter: A Step Towards Expansion

Checkout.com, a leading digital payments processor, is making strides towards obtaining a Georgia banking charter, which would allow it to operate as a merchant acquirer limited-purpose bank.This move would not only mark Checkout.com as the third company to secure such a charter—joining notable players like Fiserv and Stripe—but also significantly enhance its Checkout.com expansion plans in the U.S.

Frank Bisignano IRS Appointment: A New Era in Leadership

In a significant move, Frank Bisignano has been appointed as the new CEO of the Internal Revenue Service (IRS), marking a pivotal moment in the Trump administration’s lineup of key positions.This announcement follows his earlier appointment to lead the Social Security Administration, cementing his role in overseeing two critical federal agencies that impact millions of Americans.