New Business Funding in New Zealand is increasingly becoming a pivotal aspect for entrepreneurs looking to launch and scale their ventures. With a diverse array of funding options for startups, including venture capital and innovative crowdfunding platforms, New Zealand’s entrepreneurial scene is ripe with opportunity. Aspiring business owners can tap into government support for businesses and engage with local investors in New Zealand who are eager to back promising ideas. This introductory guide will explore the essential tips necessary to navigate the funding landscape, ensuring that new businesses have the resources they need to succeed. By understanding the available funding avenues and strategic networking, entrepreneurs can position themselves for growth and sustainability in a competitive market.

The financial landscape for emerging enterprises in New Zealand is marked by a variety of resources and support systems tailored specifically for newcomers. Entrepreneurs can choose from numerous financing methods to ignite their business journey, ranging from angel investments to community-supported crowdfunding initiatives. In this vibrant ecosystem, understanding how to leverage government assistance programs can significantly enhance the chances of securing vital funds. This discussion aims to illuminate the options available to startups, arming business owners with insightful entrepreneur tips relevant to New Zealand’s unique market environment. As we navigate through these pathways, we’ll uncover effective strategies for forging strong connections with local investors and securing essential financial backing.

Applying for a merchant account is a crucial step for businesses looking to accept payments through credit and debit cards. To start the process, you’ll need to gather essential business information including your legal business name, tax identification number, financial statements, and a valid form of identification. Some providers may also require details about your sales volumes and the types of products or services you offer. Once you have these documents ready, you can compare different merchant account providers to find one that fits your business needs, taking into consideration transaction fees, monthly costs, and contract terms.

After selecting a provider, you can typically begin the application process online through their website. Fill out the application form, ensuring all information is accurate to avoid delays. You’ll need to submit the required documents electronically for verification. This process can vary in duration depending on the provider, but many offer expedited services. Once approved, you will receive your merchant account details, allowing you to set up payment processing at your business location or online. For detailed guidance on merchants accounts and a comparison of various providers, please visit our website where you can find extra resources and a step-by-step guide to assist with your application.

Understanding New Business Funding in New Zealand

New Business Funding in New Zealand offers a spectrum of options tailored to varying needs of startups. Entrepreneurs can explore avenues such as venture capital and government grants designed to bolster their unique business ideas. The NZVIF, for example, is instrumental in channeling funds into promising ventures and serves as a critical part of the overall support ecosystem. With governmental backing, innovative startups stand a better chance at not only surviving but thriving in a competitive market.

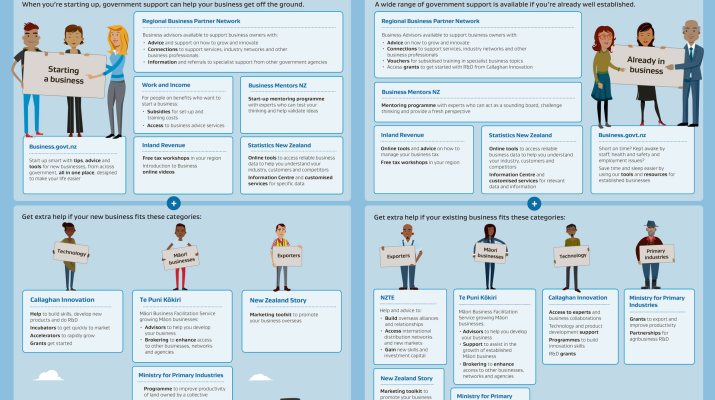

The emphasis on new business funding goes beyond mere financial assistance; it includes mentorship, networking opportunities, and tailored resources aimed at nurturing long-term growth. Entrepreneurs can access platforms that connect them with investors in New Zealand, multiplying their chances of securing vital capital. Engaging with initiatives like the Regional Business Partners Network can also provide invaluable insights and support during the critical stages of business development.

Diverse Funding Options for Startups

When considering funding options for startups, entrepreneurs should delve into a variety of sources, each offering unique benefits. For instance, angel investors not only provide capital but also bring mentorship and experience, guiding startups through complex business landscapes. Engaging with such individuals can be a competitive edge for new entrepreneurs looking to achieve breakthroughs in their respective industries.

Additionally, exploring crowdfunding in New Zealand has gained traction as a viable funding pathway for startups seeking to amass small contributions from a wide audience. Platforms like PledgeMe enable businesses to present their vision to potential backers, simplifying the fundraising process while building a community around the project. Exploring these funding options not only enhances financial resources but also contributes to a robust entrepreneurial ecosystem.

Government Support for Entrepreneurs

Government support for businesses in New Zealand plays a crucial role in fostering a fertile ground for innovation and entrepreneurship. Numerous initiatives have been launched to assist startups in navigating funding landscapes. For instance, the NZVIF not only provides capital but encourages collaboration within investor networks, increasing the likelihood of securing funds. Furthermore, programs targeting specific industries provide specialized support based on market demands, ensuring that entrepreneurs have relevant backing.

Moreover, grants offered through various government programs can ease the financial burden on startups, allowing them to focus on development rather than navigating extensive debt. By tapping into these resources, entrepreneurs can make informed decisions and leverage government initiatives to bolster their business ventures effectively. Staying updated on available government support can significantly elevate an entrepreneur’s chances of success in New Zealand’s dynamic market.

The Role of Networking in Securing Funding

Networking is a pivotal element in securing new business funding, serving as a gateway to invaluable connections within the entrepreneurial community. By actively participating in local events and engaging with industry groups, entrepreneurs can build relationships that may lead to investment opportunities. Platforms like The Icehouse, which host workshops and networking events, are ideal for fostering such relationships, enabling entrepreneurs to not only pitch but also receive constructive feedback from experienced professionals.

Additionally, forging these connections opens doors to potential investors in New Zealand, who often rely on recommendations and referrals when considering funding opportunities. The importance of building a robust network cannot be understated, as it supports knowledge sharing and collaboration among entrepreneurs at various stages of their journey. This collaborative spirit can lead to opportunities that significantly enhance the viability of business ideas.

Effective Pitching Strategies for Startups

Mastering the art of pitching is essential for entrepreneurs seeking funding, as a compelling pitch can be the difference between success and failure. An effective pitch should succinctly outline the business idea, underscore its market relevance, and articulate competitive advantages. Tailoring the presentation to suit the audience, whether it’s angel investors, venture capitalists, or grant reviewers, is crucial in making a lasting impression and increasing chances of securing funding.

Incorporating visuals, data, and storytelling into the pitch can further engage potential backers. Entrepreneurs should practice their delivery to convey confidence and passion for their venture, as this enthusiasm can resonate with investors. Emphasizing the funding requirements and demonstrating how the investment will drive growth can illustrate the idea’s potential viability, compelling investors to take the next step in supporting the business.

Latest Trends in Crowdfunding and Investment

As the landscape of funding alters dynamically, keeping abreast of the latest trends in crowdfunding and investment is imperative for entrepreneurs. The rising interest in sustainability and tech startups has directed more funding towards those sectors, signaling a shift in what investors are looking to support. Startups that align their goals with readily emerging trends have a better chance of attracting investment, as investors are not only seeking financial returns but also positive societal impact.

Additionally, innovative financing options like revenue-based financing are gaining traction, offering more flexible repayment terms that can significantly ease cash flow for startups. Entrepreneurs should stay informed about these trends, as adapting their business models accordingly can enhance their appeal to prospective investors and funding sources. Understanding these developments ensures entrepreneurs can strategically position their offerings within the market.

Utilizing Online Resources for Funding

In the digital age, leveraging online resources is essential for startups seeking funding. Websites like funders.co.nz serve as comprehensive databases that compile various funding opportunities tailored to different stages of business development. This sort of platform allows entrepreneurs to access targeted resources that align with their specific industry needs, increasing their chances of securing the right type of capital.

Moreover, utilizing online tools also enhances transparency and connectivity, as startups can more easily present their value propositions to a broad audience. This accessibility simplifies the funding search, empowering entrepreneurs to take charge of their funding journeys. Additionally, online communities can serve as networking platforms, connecting like-minded individuals eager to share advice and experiences that can elevate their entrepreneurial pursuits.

Preparing Your Business Plan for Funding

A well-prepared business plan is the foundation upon which successful funding requests are built. Entrepreneurs must ensure their business plan outlines their vision clearly, includes a thorough market analysis, and presents achievable financial projections. Investors look for clarity and realism in financial expectations, so showcasing a grounded understanding of costs and expected returns is paramount.

Aside from financial information, a business plan should also articulate a solid marketing strategy, demonstrating how the startup intends to gain traction in the marketplace. By presenting a cohesive and compelling business plan, entrepreneurs can effectively communicate their potential to investors, thus increasing their chances of obtaining the funding necessary to launch and grow their business.

The Importance of Research in Funding Opportunities

Conducting thorough research is crucial when exploring funding opportunities in New Zealand. Entrepreneurs need to grasp the landscape of available funds, understanding the different requirements and conditions attached to each option. By examining past successful funding applications, businesses can identify what appeals to investors and spotlight those attributes within their proposals.

Moreover, research allows entrepreneurs to make informed decisions about which funding avenue aligns best with their business model and long-term goals. A deep understanding of investor preferences and industry trends can empower entrepreneurs to create tailored applications that resonate with potential funders, maximizing the likelihood of securing financial support.

| Key Points | Details | |

|---|---|---|

| Current Landscape: NZ Startups | The NZ government offers funding initiatives through the NZ Venture Investment Fund (NZVIF) and the Regional Business Partners Network. | |

| Government Initiatives | Programs like the NZVIF encourage startup innovation and collaboration with angel networks. | |

| Crowdfunding Trends | Digital platforms like PledgeMe and Kickstarter are popular for raising funds through community support. | |

| Essential Preparation | Craft a comprehensive business plan including vision, market analysis, and funding needs. | |

| Networking Importance | Engage with local groups and entrepreneurial hubs for mentorship and insights. | |

| Diverse Funding Sources | Explore options like angel investors, venture capital, and grants from agencies like Callaghan Innovation. | |

| Effective Pitching | Prepare pitches that highlight your business idea and expected returns tailored to your audience. | |

| Latest Developments | New trends include increased investment in tech, sustainable energy, and revenue-based financing options. | |

Summary

New Business Funding in New Zealand is a vital aspect of the entrepreneurial landscape that can significantly influence the success of new ventures. With various funding options available, including government initiatives, crowdfunding, and angel investments, entrepreneurs must navigate the ecosystem smartly. Preparing a comprehensive business plan and networking effectively are key strategies for securing financial backing. By keeping abreast of the latest developments in funding, such as trends in sustainability and technology, entrepreneurs can increase their chances of success in transforming their ideas into thriving businesses, positively impacting New Zealand’s economy.

New Business Funding in New Zealand is a pivotal aspect for entrepreneurs aiming to thrive in the competitive landscape. As the nation fosters a vibrant ecosystem of innovation, understanding the diverse funding options for startups becomes essential. Entrepreneurs can tap into government support for businesses, venture capital, and even crowdfunding in New Zealand to fuel their growth. With strategic insights and effective networking, securing investments from both local and international investors in New Zealand can propel new ventures forward. In this dynamic environment, knowing where to seek assistance can be the key to transforming entrepreneurial dreams into reality.

Exploring financing avenues for emerging enterprises in New Zealand reveals an array of opportunities that can set entrepreneurs on the path to success. The influx of venture capital, coupled with robust government initiatives, enhances the prospects for startups looking for financial backing. Furthermore, alternative funding methods, such as community-driven crowdfunding platforms, broaden the horizons for obtaining necessary capital. As local innovation flourishes, entrepreneurs must navigate the nuances of funding options effectively to attract meaningful investments. Understanding these diverse financing solutions is crucial in harnessing the potential of New Zealand’s entrepreneurial spirit.

Frequently Asked Questions

What are the main funding options for startups in New Zealand?

New Business Funding in New Zealand offers a variety of options for startups, including angel investors, venture capital, government grants, and crowdfunding platforms like PledgeMe and Kickstarter. Entrepreneurs can tap into the New Zealand Venture Investment Fund (NZVIF) to seek venture capital. Additionally, local competitions and grants provide further support for innovative businesses.

Startups often face the challenge of securing adequate funding to kick-start their operations and drive growth. In New Zealand, there are several funding options available for startups. These include government grants, angel investors, venture capital firms, and bank loans. Additionally, startups can explore online crowdfunding platforms to gather funds from a large number of small investors. Each option has its pros and cons, and entrepreneurs must carefully assess which combination of funding sources will suit their business model and growth trajectory best.

Aspiring entrepreneurs in New Zealand can benefit from a variety of tips to navigate the complexities of starting a business. Firstly, it is vital to conduct thorough market research to understand the competitive landscape and customer needs. Networking with other entrepreneurs and attending local startup events can provide valuable insights and connections. Moreover, establishing a solid business plan that outlines goals, strategies, and financial forecasts is essential. Additionally, embracing a culture of innovation and being adaptable can help entrepreneurs respond to market changes effectively.

Investors in New Zealand are increasingly interested in exploring opportunities within the startup ecosystem. This is especially true for investors focusing on technology and sustainable businesses, which are seeing rapid growth. Platforms such as Angel Association New Zealand connect startups with angel investors, while venture capital firms are actively looking for scalable businesses to finance. Entrepreneurs seeking investment should prepare a compelling pitch that outlines their vision, market potential, and how their business stands out from competitors.

Crowdfunding has emerged as a popular option for raising capital in New Zealand, allowing entrepreneurs to reach out to a larger audience for support. Platforms like PledgeMe and GoFundMe enable startups to present their ideas and gather funds from individual backers in exchange for rewards or equity. Successful crowdfunding campaigns rely on effective communication and marketing strategies to reach potential supporters. As more Kiwis engage in this alternative funding method, startups have the opportunity to not only secure funds but also build a community of early adopters and brand advocates.

The New Zealand government offers various forms of support to assist businesses in their growth and development. Programs such as Callaghan Innovation provide funding for research and development, while NZTE (New Zealand Trade and Enterprise) offers guidance for businesses looking to expand internationally. Furthermore, there are numerous startup incubators and accelerators supported by the government that help new businesses get off the ground by providing mentorship and resources. Entrepreneurs are encouraged to leverage these supports to enhance their chances of success in the competitive landscape.

Securing funding is often one of the most pivotal steps for entrepreneurs launching new businesses in New Zealand. The landscape is rich with opportunities, but understanding the variety of funding sources available is crucial. From traditional loans to innovative crowdfunding platforms, each funding avenue has its own advantages and requirements. For instance, while banks may provide loans based on creditworthiness and financial history, platforms like PledgeMe allow entrepreneurs to engage with their target audience directly, offering them a chance to support projects they believe in. As entrepreneurs evaluate funding options, they must align their business model with the most appropriate funding source to maximize their chances of success.

Networking stands out as one of the most significant strategies for entrepreneurs seeking funding in New Zealand. By attending local meetups, industry conferences, and entrepreneurial networking events, business owners can form valuable connections that might lead to investments or mentoring opportunities. Organizations like The Icehouse offer programs designed to foster collaboration among business founders and investors. This kind of networking not only helps in finding potential investors but also helps entrepreneurs gain insights into industry trends and investment criteria, making them more attractive candidates for funding.

An essential part of the funding process is the entrepreneur’s ability to pitch their business effectively. A compelling pitch can make a substantial difference when presenting to potential investors. This involves not only showcasing the business idea but also demonstrating a deep understanding of the market, potential risks, and how the company plans to achieve its financial targets. Tailoring the pitch to resonate with the specific interests and concerns of the audience can significantly enhance its effectiveness. Therefore, entrepreneurs should practice their pitches extensively and be prepared to answer questions and address concerns that may arise during discussions.

In addition to the traditional funding routes such as venture capital and angel investors, many entrepreneurs in New Zealand are turning to grants and competitions as lucrative funding sources. Various government bodies and private organizations offer grants specifically targeted at innovative projects and startups that contribute to economic growth. Business competitions also present an excellent opportunity for entrepreneurs to attract attention, receive funding, and gain mentorship from industry leaders. Being proactive in searching for these opportunities and submitting applications can open doors that traditional funding methods may not.

Recent developments in New Zealand’s funding landscape point towards a growing emphasis on sustainability and innovation. Investors are increasingly looking for startups that are not only profit-driven but also focused on creating social and environmental impact. This shift presents a unique opportunity for entrepreneurs whose businesses align with these values. By positioning their ventures in a way that highlights both commercial viability and a commitment to sustainability, entrepreneurs can attract funding from sources that prioritize ethical investing. Keeping an eye on these trends will enable business owners to capitalize on emerging opportunities and align their business missions with investor expectations.