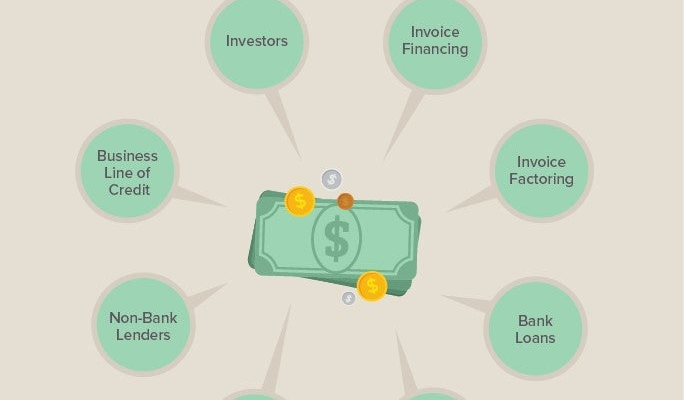

New Business Funding Options are crucial to the journey of entrepreneurs in New Zealand as they seek to transform their innovative ideas into successful ventures. With an array of funding sources available, from business grants NZ to small business loans NZ, navigating this financial landscape can be both exciting and overwhelming. Aspiring business owners can also explore venture capital New Zealand options and crowdfunding platforms NZ, which have gained popularity for their capacity to support creative projects. It’s essential to have a clear understanding of these funding mechanisms to assess which one aligns best with your business model and goals. In this guide, we’ll delve into the top new business funding options available to ensure you can secure the capital you need to launch and grow your enterprise.

In the quest for funding, entrepreneurs often encounter a plethora of viable financing avenues that cater to diverse needs and aspirations. Exploring avenues such as government sponsorship initiatives, private equity investments, crowd-sourced capital contributions, and conventional lending solutions can provide a comprehensive understanding of the financial support landscape. New Zealand’s entrepreneurial ecosystem is flourishing, presenting promising alternatives for business development. Whether through transformative grants or supportive angel investment networks, understanding these funding strategies can empower startups to realize their potential. In this article, we’ll discuss various financial solutions tailored to nurture and strengthen emerging businesses.

Exploring New Business Funding Options

As entrepreneurs embark on their journey to establish a new business in New Zealand, understanding the diverse range of funding options available is paramount. Among these, government grants stand out for their accessibility and supportiveness, particularly for startups looking to innovate and respond to market needs. Programs such as the Regional Business Partner Network and the Business Growth Grant offer financial assistance while equipping entrepreneurs with critical business advisory services. This dual approach not only provides the much-needed capital but also fosters a structured business growth path.

In addition to government support, New Zealand’s business funding ecosystem includes alternative financing options such as small business loans and venture capital. These resources are tailored to meet the unique needs of entrepreneurs at different stages of their business lifecycle. As businesses move from conception to execution, understanding which funding option aligns with their growth strategy is essential. Grants and loans may facilitate initial costs, while venture capital can provide the influx of cash needed for scaling operations.

Government Grants and Subsidies for Entrepreneurs

Government grants in New Zealand, such as those offered by **business.govt.nz**, are pivotal for entrepreneurs seeking to reduce financial burdens. These grants often come with stipulations that encourage innovation and job creation, making them a valuable resource for startups aiming to make a significant impact in their respective industries. Additionally, these funding opportunities are designed to distribute capital across various sectors, ensuring that even niche businesses have a chance to thrive.

Moreover, the availability of subsidies and grants often encourages new business ventures, allowing entrepreneurs to allocate resources more efficiently in the critical early stages of development. The Business Growth Grant’s intent to foster expansion without overwhelming financial pressure is particularly beneficial for startups, as it allows them to balance growth ambitions while maintaining operational stability.

The Rise of Venture Capital in New Zealand

Venture capital is becoming an increasingly prominent fixture in New Zealand’s funding landscape, especially for technology startups. Investors are keen on funding innovative ideas that challenge the status quo and have the potential for rapid growth. Firms like Icehouse Ventures and Movac have pioneered this sector, providing new businesses with not only capital but also valuable insights and networking opportunities that can accelerate their market presence.

Furthermore, venture capitalists tend to seek out businesses with a proven concept and a strong management team, which means that startups must adequately prepare their business models for potential investors. This aspect of the funding journey encourages entrepreneurs to refine their pitches and business strategies, thereby enhancing their overall market readiness. This evolution in the funding environment is signifying a broader recognition of the value technology and innovation can bring to New Zealand’s economy.

Utilizing Crowdfunding Platforms for Startup Success

Crowdfunding platforms like PledgeMe and Kickstarter are transforming how entrepreneurs in New Zealand approach capital raising. These platforms enable startups to engage directly with their target audience, allowing prospective customers to invest in the product before its full-scale launch. This not only provides necessary funding but also creates a loyal customer base even before the business is operational.

The advantages of crowdfunding extend beyond mere financial gain. Successful campaigns can validate a business idea, confirming that there is a market demand for the products or services offered. Additionally, managing a crowdfunding campaign can enhance an entrepreneur’s marketing skills and build relationships with potential customers and investors alike.

Small Business Loans: A Traditional Financing Avenue

While innovative funding methods are gaining traction, traditional bank loans continue to serve as a critical financing route for many new businesses in New Zealand. Banks like ASB have tailored loan packages specifically designed for small business owners, ensuring that entrepreneurs can access capital under favorable terms. This accessibility is vital, especially for businesses that require immediate cash flow support to navigate the initial phases of operation.

Moreover, the flexibility associated with small business loans can be essential for connecting entrepreneurs with funding tailored to their operational and growth needs. Entrepreneurs should consider the diverse range of loan products available, as each option may address different financial goals, whether it be covering start-up costs, purchasing inventory, or investing in infrastructure.

Emerging Alternatives in the Financing Landscape

In addition to traditional loans, alternative financing methods, such as peer-to-peer lending, are becoming increasingly popular among New Zealand entrepreneurs. Platforms like Harmoney have developed innovative ways for startups to access capital without the stringent requirements typical of conventional banks. These alternatives present a unique advantage, as they allow for quicker access to funds, which can be decisive for businesses in fast-paced markets.

The rise of alternative financing options encourages entrepreneurs to think outside the box when it comes to funding their business ventures. With less bureaucratic red tape and a more straightforward application process, new business owners can secure the necessary funds efficiently, positioning them to seize opportunities as they arise.

The Impact of Incubators and Accelerators on Startup Growth

The startup ecosystem in New Zealand flourishes with the presence of incubators and accelerators like GridAKL and The Factory, which are designed to support early-stage enterprises. These programs provide a robust framework for entrepreneurs, encompassing not just financial resources but also mentoring, training, and networking opportunities that can enhance their business viability. By participating in these programs, entrepreneurs gain insights from industry veterans, which is invaluable for navigating the complexities of starting a business.

Additionally, the community aspect of incubators fosters collaboration and creative brainstorming among peers. Entrepreneurs often find themselves surrounded by like-minded individuals who are facing similar challenges. This environment not only promotes knowledge sharing but can also lead to potential partnerships or collaborations that may not have been possible otherwise.

Understanding Your Business Funding Options

Navigating the funding landscape as an entrepreneur in New Zealand requires a clear understanding of the various options available. From government grants and small business loans to venture capital and crowdfunding options, it’s vital to thoroughly evaluate which method aligns best with specific business goals. Each funding avenue comes with its own set of advantages and intricacies, thus making informed choices essential for securing the right level of support.

Moreover, establishing a clear financial plan can heavily influence the funding decisions made by entrepreneurs. Assessing cash flow requirements, development stages, and growth aspirations will help in determining the most suitable funding options available. By proactively exploring and applying for diverse funding opportunities, entrepreneurs can create a robust foundation for their ventures and pave the way toward long-term success.

Staying Informed on New Business Funding Trends

With the funding landscape continuously evolving, it is crucial for entrepreneurs to stay updated on emerging trends and opportunities that could impact their business funding strategy. The increasing popularity of crowdfunding and a growing network of venture capitalists are changing how businesses receive financial support. Engaging with industry news, attending financial workshops, and participating in networking events can provide entrepreneurs with insights that enhance their funding acumen.

Additionally, being aware of legislative changes and new government programs can uncover additional funding possibilities that could benefit startups. The proactive pursuit of knowledge regarding available resources can significantly enhance the prospects for entrepreneurs as they seek to establish and expand their businesses in New Zealand.

Frequently Asked Questions

What are the government grants available for new business funding options in NZ?

In New Zealand, government grants for new businesses include programs like the Regional Business Partner Network and the Business Growth Grant. These initiatives offer financial support to help entrepreneurs innovate and grow their businesses, particularly in the wake of economic challenges. By leveraging these business grants, startups can reduce financial risk while focusing on development and job creation.

| Funding Option | Description | Benefits |

|---|---|---|

| Government Grants and Subsidies | Support provided by the NZ government for businesses to encourage growth and innovation. | Financial support, reduced financial risk, guidance from advisors, and a solid foundation for growth. |

| Venture Capital and Angel Investment | Investment from firms and angel investors focusing on high-potential startups, especially in technology. | Access to substantial funding for scaling, community support, and mentorship opportunities. |

| Crowdfunding Platforms | Online platforms that allow entrepreneurs to raise small amounts of money from a large number of people. | Community engagement, early market validation, and direct investment opportunities. |

| Bank Loans and Alternative Financing | Traditional lending options and emerging financing solutions like peer-to-peer lending. | Flexibility in financing, tailored products for startups, and quick access to funds. |

| Incubators and Accelerators | Programs supporting startups with funding, mentorship, and networking opportunities. | Valuable resources, mentorship, networking, and a structured path to success. |

Summary

New Business Funding Options play a crucial role in shaping the success of entrepreneurs in New Zealand. With a diverse range of funding avenues available, from government grants to venture capital and crowdfunding, new businesses can find tailored solutions that meet their specific needs. This funding landscape has evolved significantly, offering more opportunities for innovators to secure the resources necessary for growth. Entrepreneurs who effectively navigate these options can reduce financial risks and fully realize their business potential, ensuring a sustainable future in the competitive market of New Zealand.

In New Zealand, numerous business grants are available to support the growth of startups and small enterprises. These grants are provided by both government bodies and private organizations aimed at fostering innovation, research, and development. Notable examples include the New Zealand Trade and Enterprise (NZTE) grants, which offer funding assistance to businesses looking to expand internationally. Additionally, local councils often provide specific grants to support community-based projects that enhance economic development.

For entrepreneurs looking to raise larger amounts of capital, venture capital in New Zealand is an attractive option. This funding method involves investment from venture capital firms that provide necessary funding in exchange for equity in the company. Noteworthy venture capital firms such as Movac and Global from Day One focus on high-growth potential businesses, particularly in technology and digital sectors. This investment allows startups not just to secure funds but also to gain valuable mentorship and industry connections.

Crowdfunding platforms continue to gain popularity in New Zealand as alternative funding sources for startups and creative projects. Platforms like PledgeMe and Boosted allow entrepreneurs to present their ideas to the public, who can then contribute funds in exchange for rewards or equity. This method not only helps in securing the necessary capital but also serves as an effective marketing tool, helping to validate business concepts and build a community of supporters before launching.

When traditional financing options may not be accessible, small business loans in New Zealand provide an alternative funding avenue for entrepreneurs. Banks, credit unions, and alternative lenders offer various loan products tailored to meet the needs of small businesses. The Government’s Business Finance Guarantee Scheme can also assist small enterprises in obtaining loans with favorable terms, especially during challenging economic times.

Entrepreneur funding in New Zealand encompasses a variety of support mechanisms, including incubators and accelerator programs that provide mentorship, networking opportunities, and seed funding. Organizations like Startup NZ and BizDojo focus on cultivating a vibrant entrepreneurial ecosystem by connecting budding entrepreneurs with resources, advice, and funding to help them launch and scale their businesses successfully. These initiatives are critical in nurturing innovation and sustaining economic growth in the region.

Applying for a merchant account involves several steps that ensure your business can effectively accept credit and debit card payments from customers. The first step is to choose a payment processor or bank that offers merchant account services that align with your business needs. It’s essential to compare different providers to find one that offers competitive fees, trustworthy customer support, and a user-friendly interface. Once you’ve selected a provider, you’ll need to fill out an application form, which typically requires information about your business, such as its legal structure (e.g., sole proprietorship, partnership, corporation), estimated transaction volume, and the types of products or services you sell.

After submitting your application, the provider will conduct a review, often involving a credit check and an evaluation of your business’s financial history. It is beneficial to have your personal and business financial documents ready, as they may need to be provided during this process, including bank statements, tax returns, and proof of identity. Once your application is approved, you can set up your payment processing system, which may involve integrating a payment gateway with your website for online transactions or setting up point-of-sale devices for in-person sales. For detailed guidelines and assistance throughout the application process, you can visit [this comprehensive resource](https://www.example.com).