New business funding is a vital aspect every entrepreneur must master for a successful startup journey. Navigating through various business funding options can seem overwhelming, but understanding the landscape is crucial for any budding enterprise. Whether it’s the best funding sources for startups such as angel investors or government grants for startups, there’s a wealth of information available. Additionally, innovative methods like crowdfunding for small businesses are transforming the funding landscape, allowing entrepreneurs to gain capital directly from supporters. In this guide, we will explore the essential strategies for financing your startup and setting a strong foundation for future growth.

Initiating a startup can be daunting, especially when considering the myriad of financing avenues available to new entrepreneurs. This discussion will delve into startup capital options, emphasizing how crucial it is to identify the most effective financial strategies early on. From exploring expansive funding avenues to leveraging digital platforms for investment, understanding your startup’s funding needs is essential. Various financial instruments and assistance programs are available to foster entrepreneurial ventures, thus reshaping the financial ecosystem. Ultimately, grasping these concepts will not only enhance your approach to securing resources but will also significantly elevate your business’s potential for success.

Understanding the Landscape of New Business Funding

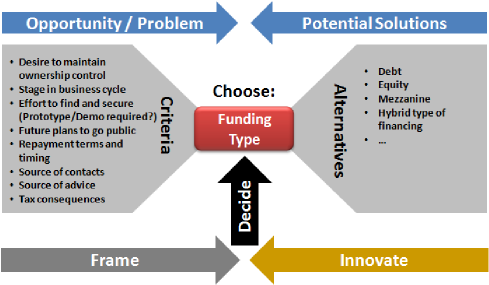

Navigating the new business funding landscape requires a clear understanding of the various funding options available to entrepreneurs. As you embark on your startup journey, it’s crucial to consider not just conventional avenues such as bank loans and venture capital, but also alternative sources like crowdfunding and angel investments. Each funding source has its own advantages and requirements, which can significantly influence the direction of your startup. Understanding these nuances will help you identify which type of funding aligns best with your business model and growth objectives.

In addition, the role of government grants cannot be understated. Many entrepreneurs are unaware of the financial support available through local and national grant programs designed to stimulate business growth. Engaging with resources like the Small Business Administration (SBA) can unlock opportunities that provide substantial funding without the burden of repayment. Thus, having a comprehensive approach to exploring business funding options will empower you to secure the financial backing needed to bring your vision to life.

Best Funding Sources for Startups: A Comprehensive Guide

When considering the best funding sources for startups, it’s essential to undertake a multi-faceted approach. Traditional options like bank loans may offer stability with structured repayment plans, making them an appealing choice for established entrepreneurs. However, startups often lack the necessary credit history, leading many to explore alternative avenues. Crowdfunding has emerged as a prominent source of funding for small businesses, allowing entrepreneurs to showcase their ideas and gather support from individuals passionate about their project. Platforms such as Kickstarter and Indiegogo enable you to engage directly with your market while validating your business concept.

Moreover, angel investors present a lucrative alternative for startups, particularly those seeking mentorship alongside funding. Unlike venture capital firms, angel investors tend to take more risks by investing in early-stage businesses in exchange for equity. Their experience and networks can provide invaluable support as you navigate the challenges of establishing your business. Striking a balance between leveraging diverse funding options will not only diversify your financing sources but also increase your startup’s resilience against market fluctuations.

The Rise of Crowdfunding for Small Businesses

Crowdfunding for small businesses has transformed the way entrepreneurs secure funding, providing a democratic platform for individuals to invest in the early stages of a business. This method allows startups to bypass traditional funding constraints by tapping into the collective financial power of the public. Successful campaigns not only raise funds but also create a community of early adopters who are invested in the success of the venture. Moreover, the visibility gained through crowdfunding can enhance brand recognition and marketability, making it a valuable tool for new businesses.

However, launching a successful crowdfunding campaign requires strategic planning and execution. Entrepreneurs must craft a compelling narrative that resonates with potential backers, highlighting the unique value proposition of their product or service. Engaging visuals, informative videos, and clear financial goals are pivotal elements of a successful campaign. Additionally, effective marketing strategies, such as leveraging social media to reach your audience, can significantly increase your chances of achieving your funding target.

Government Grants for Startups: Unlocking Financial Support

Government grants for startups offer a promising avenue for entrepreneurs seeking financial support without the burden of debt. Various federal, state, and local government programs exist to promote innovation and small business development. Programs administered by the Small Business Administration (SBA) include grants targeted at specific industries, community development projects, or technological advancements. By researching and applying for these grants, you can secure crucial funding to kickstart your business initiatives.

Additionally, many local municipal governments offer grants to stimulate economic growth and job creation in their areas. These grants can range widely in purpose, from supporting green initiatives to encouraging tourism. Understanding the specific goals of these programs enables entrepreneurs to write more targeted applications that align with the grant’s objectives, improving the likelihood of approval. By tapping into government grants, startups can significantly reduce initial financial pressure, allowing them to allocate resources toward growth and development.

Financing Your Startup: Innovative Solutions and Trends

Financing your startup in today’s rapidly evolving market requires an openness to innovative solutions and the latest trends in business funding. Traditional models, while still relevant, often fall short in addressing the unique needs of new businesses. The rise of financial technology, or fintech, has introduced new ways for startups to secure financing. Digital lenders can provide quicker response times and tailored financing solutions that traditional banks may not offer, thus expediting the funding process and offering a lifeline when cash flow is tight.

Moreover, startups can leverage accounting and financial management software to enhance their financial health and present a solid case to potential investors. Tools such as QuickBooks not only help in managing daily financial operations but also assist in preparing detailed funding applications. By using technology to streamline financial processes, startups can present a well-structured and compelling narrative to investors, thus increasing their chances of successful funding.

Networking: The Key to Securing Business Funding

Establishing a robust network can be the backbone of securing business funding. Networking with other entrepreneurs, industry experts, and potential investors can provide insights into best practices and opening doors that may lead to funding opportunities. Attending industry events, workshops, and startup competitions not only increases visibility but also enhances your credibility as an entrepreneur. Engaging with seasoned professionals equips you with valuable knowledge and connects you with potential collaborators who may share similar goals.

Furthermore, building relationships with investors is crucial in cultivating trust and increasing the likelihood of funding discussions. Having a personal connection with potential backers can significantly influence their decision to invest in your business. As you share your journey and business aspirations during networking events, you create an opportunity for investors to see the passion and commitment behind your startup, ultimately fostering deeper connections that can lead to fruitful funding ventures.

Crafting a Compelling Pitch for Investors

A compelling pitch is essential for attracting investors to your startup. This presentation serves as your opportunity to concisely communicate your business vision, distinguishing features, and financial potential. An effective pitch should highlight your clear value proposition, showcasing what makes your product or service unique in the marketplace. Incorporating compelling storytelling, combined with solid data on market trends and customer demographics, can create a persuasive narrative that resonates with potential investors.

Additionally, showcasing realistic financial projections can instill confidence in your ability to manage funds effectively. Providing clarity on how you plan to utilize the funding can demonstrate your commitment to achieving tangible results. Remember that investors are not just looking for innovative ideas; they want to see a well-thought-out plan that outlines how their investment will contribute to your startup’s success. A polished pitch transforms your concept into a viable business proposal that grabs attention and secures necessary funding.

Adapting to Trends in Business Funding

As the business landscape is continually evolving, staying attuned to trends in business funding is vital for entrepreneurs seeking financial success. The recent surge of interest in environmental, social, and governance (ESG) criteria among investors means that businesses showcasing their commitment to sustainability may have access to additional funding opportunities. Entrepreneurs who integrate these principles into their business models can appeal to a growing base of socially conscious investors and customers alike.

Furthermore, the rise of unique funding mechanisms such as revenue-based financing offers an alternative for startups seeking flexible repayment options. This trending funding model allows companies to pay back investors based on their revenue, thus linking repayment to performance and allowing businesses to grow without the stress of fixed repayment schedules. Keeping an eye on these trends will enable you to adapt your funding strategy, ensuring that you remain competitive and well-positioned in the market.

Maximizing Your Success with New Business Funding Strategies

To maximize your chances of success with new business funding strategies, it’s crucial to approach funding as an integral part of your overall business plan. Developing a strategic mix of different funding sources can create a robust financial foundation for your startup. This diversification reduces reliance on a single source of capital while allowing for more flexibility in managing cash flow during various stages of growth.

Incorporating comprehensive research into your funding strategies will enhance your preparedness and enable you to present a strong case to potential investors. Understanding industry benchmarks, consumer behavior, and market trends can provide crucial context for your funding needs. Armed with this knowledge, you can navigate the funding landscape with confidence, making informed decisions that align with your startup’s objectives. By actively pursuing innovative funding solutions and remaining adaptable, you are setting your business up for long-term success.

Frequently Asked Questions

What are the best funding sources for startups looking for new business funding?

When considering new business funding, startups have several options available. The best funding sources include traditional loans from banks, venture capital investment, and alternative options like crowdfunding for small businesses. Additionally, government programs, such as SBA loans and local grants, can provide significant support. Each option has its pros and cons, so it’s important for entrepreneurs to evaluate their specific needs and resources to find the most suitable funding path.

| Key Points | Details |

|---|---|

| Understanding Your Funding Needs | Create a detailed business plan to determine startup costs, operational expenses, and projected revenue. |

| Traditional Funding Sources | Includes bank loans and venture capital, which require a strong business case and often careful scrutiny. |

| Alternative Funding Trends | Crowdfunding and angel investors provide more flexible funding options and mentorship. |

| Government Grants and Programs | SBA loans and local grants support startups, especially those in underserved areas. |

| Utilizing Financial Technology | Fintech platforms streamline funding applications and financial management for entrepreneurs. |

| Networking: The Key to Success | Building connections with investors and mentors can enhance funding opportunities. |

| Crafting a Compelling Pitch | Present a clear value proposition, market analysis, financial projections, and a utilization plan. |

Summary

New Business Funding is crucial for aspiring entrepreneurs aiming to transform their innovative ideas into successful ventures. In this guide, we highlighted various traditional and alternative funding sources, the importance of understanding your specific funding requirements, and the significance of building networks and crafting compelling pitches to attract investors. By leveraging the insights provided, entrepreneurs can navigate the complexities of securing funding effectively, thus setting a strong foundation for long-term success.

When pursuing business funding options, entrepreneurs have a variety of avenues to consider. Traditional methods such as bank loans and lines of credit are often utilized, but they typically require a solid business credit history and collateral. Alternatively, newer funding options have emerged in recent years, such as peer-to-peer lending platforms and microloans, which can provide more accessible financing for small business owners. Furthermore, angel investors and venture capitalists are viable routes for startups looking to scale quickly, as they not only offer capital but also mentorship and networking opportunities.

For startups, identifying the best funding sources is crucial to ensure sustained growth and success. Many entrepreneurs initially turn to personal savings or funds from friends and family, which can be less intimidating than formal financing. Once a business begins to take shape, options like startup incubators or accelerators can provide funding along with vital resources such as networking and business training. Moreover, utilizing crowdfunding platforms allows startups to gauge market interest while raising necessary capital, making it a popular choice for those with innovative products or services.

Crowdfunding has emerged as an essential funding strategy for small businesses, enabling them to raise capital from a large group of people, typically via online platforms. This method not only facilitates access to funds but also helps in building a customer base and validating a business idea before significant investments are made. Entrepreneurs can leverage platforms like Kickstarter and Indiegogo to showcase their projects and attract funding in exchange for early access to products or other rewards. This approach amplifies marketing efforts and creates a community of supporters who are invested in the success of the business.

Government grants for startups offer a non-dilutive funding option, meaning entrepreneurs can access capital without giving up equity in their companies. Various government agencies provide grants based on specific criteria, such as innovation potential, industry focus, or demographic targets. For example, the Small Business Innovation Research (SBIR) program is designed to support technological innovation in small businesses, while local grants can often be found aimed at promoting economic development in specific regions. Navigating these grants can be competitive and may require detailed proposals, but the financial benefits can be substantial for qualifying businesses.

Financing your startup is a multi-faceted journey that often requires a blend of strategies to create a robust financial foundation. In addition to the options mentioned previously, entrepreneurs should also consider alternative sources like business competitions, where startups can win cash prizes and gain visibility. As businesses grow, maintaining a healthy financial strategy is crucial, including careful budgeting, tracking expenses, and planning for future funding needs. Many startups also benefit from utilizing accounting tools and finance software to manage their finances effectively, ensuring that they remain agile in responding to evolving market conditions.