Open banking is revolutionizing the financial landscape by facilitating seamless access to consumer financial data among banks and fintech companies. This innovative system empowers consumers to have greater control over their financial information, enabling them to make informed decisions and switch between financial institutions with ease. As the October 21 deadline approaches for public comments to the Consumer Financial Protection Bureau (CFPB) regarding proposed open banking rules, the potential benefits are becoming increasingly clear. Banks are beginning to recognize that the open banking model not only enhances competition but also offers them valuable insights into customer preferences. By embracing this collaborative approach, banks and fintech can work together to create a more inclusive financial ecosystem that benefits everyone involved.

The concept of open banking, often referred to as shared banking or consumer-centric financial services, is reshaping how financial institutions interact with their clients. This model encourages transparency and empowers consumers to access their financial data freely, allowing them to explore various services offered by banks and fintech entities. As the dialogue around modernizing financial regulations intensifies, support for innovative consumer finance solutions has been building in Congress, reflecting a bipartisan acknowledgment of the potential for a more dynamic market. Ultimately, this shift signals a new collaboration between traditional banking institutions and financial technology startups, ensuring that all consumers, regardless of size or location, can benefit from advanced financial tools and insights.

Understanding Open Banking: A New Paradigm for Banking and Fintech

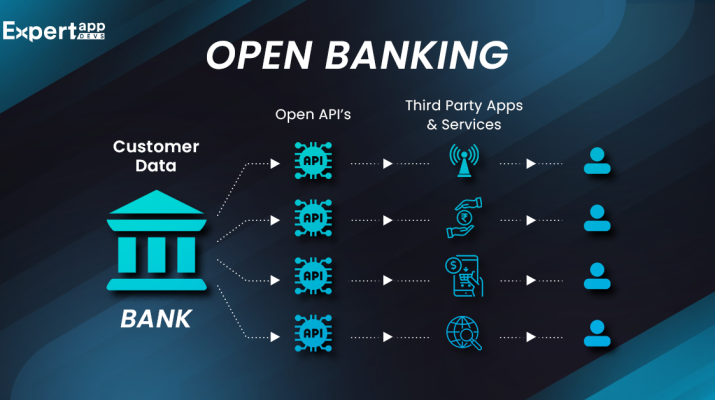

Open banking represents a fundamental shift in the way financial data is shared and utilized, enabling both traditional banks and fintech companies to work together more collaboratively. By allowing consumers to share their financial information securely with third-party providers, open banking enhances transparency and expands the array of financial products and services available to consumers. This shift challenges the conventional notion that banks operate in isolation, revealing how both banks and fintechs can leverage consumer financial data to better understand customer needs and preferences.

Moreover, the partnership between banks and fintechs through open banking facilitates innovation and competitiveness in the financial services industry. As banks access rich consumer insights provided by fintech companies, they can develop more tailored offerings that cater to specific customer segments. This mutually beneficial relationship strengthens the ecosystem, ensuring that both banks and fintechs can thrive in an increasingly digital landscape, enhancing market insights, driving consumer engagement, and ultimately promoting better financial outcomes.

The Benefits of Open Banking for Banks and Fintechs

Open banking offers a range of benefits for both banks and fintech companies, fostering an environment ripe for collaboration and innovation. For banks, open banking can streamline operations by providing access to real-time data on consumer interactions across various fintech platforms. This influx of information enables banks to identify trends, enhance customer service, and create competitive products that meet modern consumers’ evolving needs. Consequently, banks can position themselves as proactive institutions that prioritize customer experience.

For fintechs, open banking reduces barriers to entry within the financial services market, allowing them to access consumer financial data more seamlessly, which is vital for creating and scaling innovative solutions. This data democratization empowers smaller fintech startups to compete with larger institutions by leveling the playing field. Additionally, it drives down costs associated with customer acquisition and retention, supporting new business models that rely on agility and responsive customer interactions.

Regulatory Landscape of Open Banking: The Role of the CFPB

The Consumer Financial Protection Bureau (CFPB) plays a crucial role in shaping the open banking environment in the United States. By establishing regulations that govern the access and sharing of consumer financial data, the CFPB aims to create a framework for transparency and consumer protection. These rules, particularly those enacted during the Biden administration, are designed to empower consumers by giving them greater control over their financial information while promoting competition among financial service providers.

As the CFPB revises its open banking rules, industry stakeholders, including banks, fintech companies, and advocacy groups, have actively engaged in the discussion. This dialogue underscores the importance of finding a balanced approach that safeguards consumer interests while enabling innovation within the industry. The upcoming revisions and public comments are pivotal in shaping the future of open banking, ensuring that the benefits are accessible to all consumers, including those in underserved communities.

Impact of Open Banking on Consumer Financial Data Privacy

As open banking continues to gain momentum, concerns regarding consumer financial data privacy also come to the forefront. The open sharing of financial information necessitates stringent measures to protect sensitive data from unauthorized access and potential misuse. Consumers must be assured that their financial data is handled responsibly by all parties involved, ranging from banks to fintech companies and beyond.

Regulatory frameworks like those established by the CFPB are essential in mitigating privacy risks associated with open banking. Transparency in how consumer financial data is used and shared promotes trust between consumers and financial institutions. As both banks and fintechs work collaboratively to enhance data security, they must also educate consumers about their rights and the benefits of participating in an open banking ecosystem to foster a more secure environment.

Open Banking: Bridging the Gap for Rural Businesses

Open banking holds the promise of bridging financial access gaps for rural businesses that have historically faced challenges in obtaining financial services. By facilitating access to high-quality financial tools and insights, open banking can empower small businesses in underserved areas—allowing them to operate more efficiently and compete more effectively in the marketplace. This paradigm shift is especially beneficial as it enables rural entrepreneurs to harness the power of financial data to make informed decisions.

As Mackenzie Burnett from Ambrook suggests, the adoption of open banking is crucial to ensuring that small and rural businesses have access to the same resources and opportunities available to their larger counterparts in urban settings. The focus on inclusivity within the open banking framework can help foster economic growth, enabling small businesses to thrive while enriching the overall financial ecosystem. Furthermore, this balance promotes community resilience, supporting the sustainability of rural economies.

Consumer Empowerment through Open Banking Initiatives

Open banking initiatives are fundamentally aimed at empowering consumers by granting them control over their personal financial data. By enabling consumers to share their financial information securely with trusted third-party providers, open banking allows for a more personalized banking experience, tailored to individual preferences and needs. This newfound control not only enhances customer satisfaction but also promotes greater financial literacy among users.

With access to a variety of financial services through open banking, consumers can easily transition between different providers, making more informed choices. Such empowerment leads to a competitive landscape that fosters innovation and encourages financial institutions to continuously improve their services. Ultimately, consumers benefit from better pricing, product options, and an overall enhanced experience within the financial services sector.

The Future of Banks in an Open Banking Ecosystem

As the open banking landscape evolves, banks will need to adapt to stay competitive in an increasingly digital and collaborative environment. Embracing open banking can help banks enhance their service offerings by leveraging consumer insights garnered from fintech collaborations. This adaptation will not only ensure their relevance in the market but also encourage them to innovate and modernize their operations in line with consumer expectations.

Furthermore, banks will need to shift their mindset from viewing fintech as competition to seeing it as a valuable partner in delivering better financial products and services. By fostering a culture of innovation and collaboration, banks can position themselves as leaders in consumer financial data management, ultimately enhancing their relationship with customers and creating a more inclusive financial landscape.

Challenges Facing Fintech Companies in the Open Banking Era

Despite the myriad opportunities presented by open banking, fintech companies face significant challenges in this rapidly evolving landscape. One of the primary concerns is the potential for increased operational costs arising from compliance with regulations and fees associated with accessing consumers’ financial data. New fees imposed by large banks could disproportionately affect smaller fintech startups, hindering their ability to provide affordable services and ultimately challenging their sustainability.

Additionally, the ongoing litigation involving the CFPB’s open banking rules raises uncertainties that could impact fintechs’ strategic plans for growth. The key for fintech companies moving forward will be to navigate these challenges effectively while continuing to innovate and offer compelling financial solutions that meet consumers’ evolving needs. By demonstrating their value and the importance of open banking to consumers, fintechs can work to secure their position in the marketplace.

Open Banking Collaboration: Banks and Fintechs Working Together for Consumers

The synergy between banks and fintechs through open banking initiatives can reshape the financial services landscape, presenting new opportunities for collective innovation. Collaboration allows both entities to leverage their respective strengths: traditional banks can provide stability and trust, while fintechs can introduce agility and innovative technology solutions. This partnership can lead to the development of sophisticated tools that improve customer experiences and promote financial inclusion.

This concept of collaboration underscores the idea that a successful open banking ecosystem is not about competition, but rather about creating a win-win scenario for consumers, banks, and fintechs. By working together, these institutions can enhance the overall customer journey, drive efficiencies, and create more tailored financial products that cater to diverse consumer needs. The future of finance, therefore, lies in the ability of banks and fintech companies to transcend traditional barriers and foster a collaborative environment.

Frequently Asked Questions

What is open banking and how does it relate to fintech companies?

Open banking refers to a system where banks and fintech companies can share consumer financial data with authorized third parties, allowing users more control over their financial information. This new dynamic not only enhances competition but also benefits both banks and fintechs by creating valuable market insights and improving financial services.

How does open banking benefit consumers?

Open banking benefits consumers by allowing them to securely share their financial data with multiple banks and fintech companies, fostering greater transparency and choice in their financial decisions. This leads to more innovative financial products and services tailored to individual needs.

What role does the CFPB play in the open banking system?

The Consumer Financial Protection Bureau (CFPB) oversees the implementation and regulation of open banking policies in the U.S. It aims to ensure consumer protection and facilitate an environment where consumer financial data can be used securely and efficiently to promote competition among banks and fintech companies.

How do banks benefit from adopting open banking practices?

Banks benefit from open banking by gaining access to real-time consumer data from fintech companies, enabling them to better understand customer preferences and improve their service offerings. This collaboration can lead to enhanced customer loyalty and increased operational efficiency.

What challenges do fintech companies face with open banking regulations?

Fintech companies face challenges such as potential fees for data access imposed by banks, which could hinder their ability to operate sustainably. Additionally, there is a need for a clear regulatory framework from the CFPB to ensure that the open banking system is equitable and beneficial for all parties involved.

How does open banking promote competition in the banking sector?

Open banking promotes competition by allowing fintech companies to innovate and offer services that meet diverse consumer needs. This environment encourages banks to enhance their own offerings, ultimately benefiting consumers through improved financial products and competitive pricing.

What is the significance of the Dodd-Frank Act in relation to open banking?

The Dodd-Frank Wall Street Reform and Consumer Protection Act lays the foundational regulatory framework for open banking. It aims to increase transparency and consumer control over financial data, facilitating easier transitions between financial institutions and thereby enhancing competition in the banking sector.

Why is bipartisan support important for the future of open banking?

Bipartisan support is crucial for the future of open banking as it reflects a collective recognition of its potential to improve financial systems and consumer protection. Such support helps in the swift implementation of open banking regulations that can benefit both consumers and financial institutions.

What are some potential consequences if open banking regulations are not properly implemented?

If open banking regulations are not properly implemented, it could lead to increased costs for fintech companies, potentially stifling innovation and limiting consumer access to diverse financial services. This lack of access may disproportionately affect smaller businesses and rural communities, thereby widening the financial services gap.

How can open banking create opportunities for smaller businesses?

Open banking can create opportunities for smaller businesses by providing them with access to advanced financial tools and insights traditionally available only to larger institutions. This democratization of access allows smaller entities to compete more effectively and grow within the financial ecosystem.

| Key Point | Details |

|---|---|

| Open Banking Benefits | Facilitates data flow between banks and fintechs, enabling enhanced consumer insights. |

| Misunderstanding Between Banks and Fintechs | It’s not a competition; data can flow both ways, benefiting both sectors. |

| Bipartisan Support | Current policies for open banking enjoy support from both parties in Congress. |

| Impact of Fees | Fees imposed by banks on data access can threaten fintech sustainability. |

| Education Gap | Banks need to realize fintechs can enhance their service and competitiveness. |

| Access for Small Businesses | Open banking is crucial for providing equal financial opportunities for smaller businesses. |

Summary

Open banking is poised to transform the financial landscape by facilitating smoother exchanges of consumer financial data between banks and fintech companies. This system allows both sectors to gain valuable insights that can drive innovation and improved services. However, there are challenges, like the imposition of access fees and ongoing legislative discussions, that need to be addressed to ensure the system’s viability and inclusiveness. As banks and fintechs work together, the potential for a more equitable financial ecosystem emerges, benefiting consumers and small businesses alike.

Source: https://www.paymentsdive.com/news/open-banking-fintechs-payments-account-access/802561/

Fintech companies have revolutionized the financial landscape by introducing innovative solutions that cater to both consumers and businesses. These companies leverage technology to offer services like digital payments, lending, investment, and personal finance management, often with lower fees and increased accessibility compared to traditional banking systems. As a result, they have garnered significant attention and investment, playing a crucial role in the evolution of financial services.

The Consumer Financial Protection Bureau (CFPB) has emerged as a key regulatory body overseeing the operations of both fintech companies and traditional banks. Established to protect consumers from unfair, deceptive, or abusive practices in the financial sector, the CFPB’s involvement ensures that fintech firms adhere to established regulations while promoting transparency and accountability. By fostering a balanced regulatory environment, the CFPB aims to encourage innovation while safeguarding consumer financial data.

In the realm of consumer financial data, the sharing and utilization of information are paramount for personalized financial services. Fintech companies often seek access to consumer data from traditional banks to enhance their offerings. This relationship can lead to improved financial products tailored to individual consumer needs, but it also raises significant concerns about data privacy and security. The challenge lies in ensuring that consumers have control over their data while also benefiting from the advances in financial technology.

The collaboration between banks and fintech companies has become increasingly important, as traditional financial institutions recognize the need to adapt to a rapidly changing landscape. By partnering with or adopting fintech solutions, banks can enhance their service offerings, compete more effectively, and better address the demands of tech-savvy consumers. This synergy often results in a more comprehensive financial ecosystem that benefits all parties involved.

Open banking has emerged as a significant trend within the financial sector, offering numerous benefits that extend to consumers and businesses alike. By allowing third-party developers to access consumer banking data (with consent), open banking fosters innovation and competition, leading to improved products and services. Consumers can enjoy enhanced experiences, such as streamlined transactions, personalized financial advice, and better budgeting tools. Moreover, open banking can facilitate greater financial inclusion, giving underserved populations access to essential financial services.